IBM bets big on generative AI

Although Q2 revenue was flat year-on-year, it was buoyed by IBM’s hybrid cloud and AI strategy. The tech giant will build up its AI capabilities similarly to how it’s dealt with Red Hat OpenShift.

IBM is going all in on generative AI with recent efforts and investments in the space, including an enterprise AI and data platform and a new Center of Excellence.

During the company’s Q2 earnings call on July 19, chairman and CEO Arvind Krishna stressed that IBM’s focus is on enterprise AI to solve business problems. He added that AI is being “infused” into IBM’s software products and that the company is currently building products to address specific enterprise use-cases.

At the heart of its efforts is Watsonx, its enterprise-ready AI and data platform. IBM previewed Watsonx, which aims to help organizations accelerate and scale AI, at its Think conference in May.

The platform has a studio for new foundation models, generative AI, and machine learning; a data store built on an open lakehouse architecture; and a toolkit to enable firms to build AI workflows with responsibility, transparency, and explainability.

IBM will build up its AI capabilities similarly to what it did with the Red Hat OpenShift hybrid cloud platform, which it acquired in 2019 for $34 billion.

“In the same way we’ve built a consulting practice around Red Hat’s hybrid cloud platform that is now measured in the billions of dollars, we will do the same with AI. And just like OpenShift is the technology platform at the heart of our hybrid cloud capabilities, Watsonx will be the core technology platform for our AI capabilities,” Krishna said.

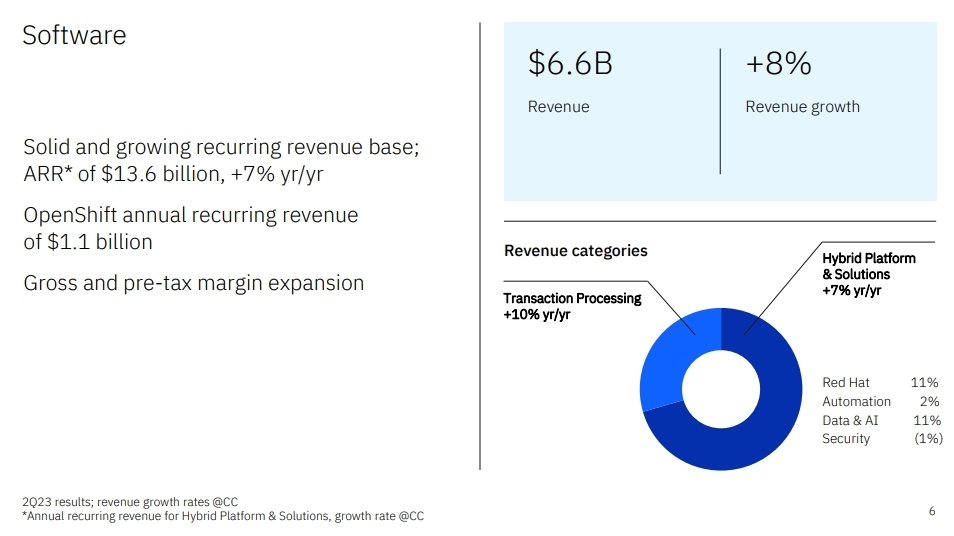

IBM’s hybrid cloud and AI strategy, which underpin its software and consulting businesses, helped prop up its revenue for the quarter. Overall revenue stayed relatively flat at $15.5 billion; however, the software segment recorded $6.6 billion in revenue, up 7.2% from the year before, thanks to growth across its hybrid platform and solutions—led by Red Hat and data and AI—and transaction processing.

Red Hat OpenShift now has $1.1 billion in annual recurring revenue, which Krishna said signals what’s to come for its AI business.

“As I think about how OpenShift, which was a Red Hat product that came in 2019, it grew literally double each year for the first four years. And at this point, the revenue is about 10 times what it was when it came in. And right now, we have quantified it at $1.1 billion on an annualized run rate basis. So that gives you a sense of the excitement we have around these projects, these technologies, and what it could do for us as you begin to go forward,” he said.

Krishna said Watsonx was formally rolled out just over a week ago and that businesses are tapping into foundation models and machine learning in one place using their own data to accelerate generative AI workloads.

One example he highlighted is Citi’s pursuit of using large language models (LLMs) for connecting controls to internal processes. Meanwhile, NatWest is embedding Watsonx into its chatbot to improve the customer experience.

“We believe the opportunity for large language models for enterprise companies is immense given the existing amount of business data,” he said. This is where Watsonx comes in as it leverages multiple models—rather than relying on a single model—which include open-source technologies, IBM’s models, or models co-created with IBM.

To help firms capitalize on the AI opportunity, IBM has more than 20,000 data and AI consultants and has recently launched its Center of Excellence for generative AI, which is staffed by over 1,000 consultants specialized in the new cutting-edge field.

That said, generative AI, which includes systems such as OpenAI’s ChatGPT, has a long way to go in terms of its use within the capital markets. While many deem the tech as “first generation,” future iterations could shake up the financial services industry, in part by evolving the role of analysts in the way critical infrastructure is built. On the other hand, financial firms could face regulatory compliance headwinds when looking to experiment with generative AI.

Krishna also addressed IBM’s plans to acquire Apptio, a financial and operational IT management and optimization software provider, for $4.6 billion. A key addition Apptio will bring to the table is $450 billion worth of anonymized IT spend data, which will provide insights and benchmarks to help C-level executives manage tech investments.

“We expect that over time, we’ll be able to monetize that into a large language or foundation model and be able to give people even better predictors of where they can take their spend,” he said.

The Apptio deal is expected to close in the second half of 2023, subject to regulatory approvals and other customary closing conditions.

As for IBM’s future appetite for M&A, Krishna said that while the company is always on the lookout for prospective businesses, particularly in hybrid cloud, data and AI, automation, cyber, and consulting, they must meet IBM’s criteria.

“My criteria is pretty straightforward: Does it align with our strategy? Does it actually give us synergy? Meaning, can the combined entity grow faster than the individuals could before?” he said. “And if it is larger, it has to be accretive. … If it meets those criteria, it’s certainly an attractive proposition.”

Krishna said the Apptio acquisition meets three or four of those criteria. “It hits hybrid cloud because it helps you deploy those. It hits big data and AI property because that’s what they use. And it hits automation because it takes out human labor costs from any of those processes. So it was actually a very, very good fit,” he said.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.