Waters Wrap: The DTCC, Cusip and questions of a monopoly

While the companies that oversee Cusips find themselves embroiled in a lawsuit, Anthony questions where the DTCC stands in this unfolding drama.

Need to know

UPDATE 2/15/2023: Cusip Global Services, S&P Global, FactSet, and the American Bankers Association filed their joint motion to dismiss the ongoing class-action suit against them. More coverage to follow.

2/14/2023: Cusip Global Services, S&P Global, FactSet, and the American Bankers Association are expected to file their joint motion to dismiss the ongoing class-action suit against them, brought by New York broker-dealer Dinosaur Financial Group and European real estate investor Swiss Life Investment Management on behalf of all entities who pay license fees to use Cusip numbers in their businesses.

The plaintiffs will have a deadline of April 3, 2023, to respond to the motion.

The defendants will have a further deadline of April 27, 2023, to make their case for dismissal once again before SDNY Judge Katherine Failla rules on whether to let the case proceed to trial, as requested by the plaintiffs.

If you’re a regular reader of WatersTechnology, you likely know that there is a potentially market-changing case winding its way through the Southern District of New York courthouse against the companies involved with the oversight and distribution of Cusip identifiers. (If you don’t know and want a detailed explainer of what’s going on, click here.)

Quickly, though, at the heart of the case is the allegation that Cusip Global Services, S&P Global (the former owner of CGS), FactSet (its current owner), and the American Bankers Association (the patent owner of the Cusip standard) have violated sections 1 and 2 of the Sherman Antitrust Act, which was enacted in 1890 to protect against monopolistic behavior. In this column, I’m going to focus on that “monopolistic” piece and whether I think the accusation could extend beyond the quartet of companies named in the suit.

Last month, the Depository Trust & Clearing Corporation released a whitepaper that broadly discussed the future of data management in the capital markets. In it, the DTCC said that it expects that “the industry will continue to adopt more standard data models,” and that “the benefit for the industry would be less redundancy and better quality in data across the financial industry.” Later, the paper stated that “open-source data standards will take the pain out of routine tasks.” In this case, the DTCC is highlighting open-sourced API libraries, software development kits, and even blockchain…don’t get me started on that last one.

After the release of the paper, Kapil Bansal, managing director and head of business architecture, data strategy and analytics at the DTCC, spoke with trade publication The Asset, during which he doubled down on the DTCC’s support and advocation for open-source data standards.

The reason I find this paper interesting—if not peculiar—is because the DTCC processes nearly all equity, corporate, and municipal debt transactions in the US, yet allows only Cusip codes to be used in settlement. Cusips have been in use for more than half a century; despite being more semantic than technological, they are a legacy technology. And while it’s the de facto identifier for settlement in the US (and Canada), there is another identifier that could be used—the Financial Instrument Global Identifier, or Figi.

Developed by Bloomberg in 2009, Figi became an authorized data standard for financial instrument identification in the US in September 2021. It’s been under the governance of the non-profit standards body Object Management Group since 2015, while Bloomberg has remained the registration authority and a certified provider. Unlike Cusip, which has been described as a “cash cow” for S&P (and now FactSet), the Figi is open-source under the MIT License and free to use.

“While Figi was established by Bloomberg, it’s an open-source, universal option that was designed to solve a problem that has existed from day one. But the old constituents didn’t have the wherewithal to solve the problem because of competitive respect or whatever,” says a former executive director at a tier-1 US bank. “That’s the real underlying issue.”

Allow me to start connecting some dots as I see them laid out. The core theme of the whitepaper penned by the DTCC advocates for helping the industry be more efficient, cut costs, and future-proof organizations. Now, when the industry utility is talking about open-source data standards—once again—it’s talking about APIs, SDKs and DLTs—it never talks about identifiers. In my opinion, though, it begs the question: why not?

Cusip is the identifier in the US because the DTCC will only accept Cusips for settlement in the US. If the DTCC—the largest settler of trades in the US—were to allow market participants to identify and settle their trades with a competing code, one wonders whether the Cusip franchise would be the so-called cash cow it currently is.

“The entire US settlement and clearing is predicated on that special nine-character number; you can’t operate without it—that’s what is lost on the industry, regardless of the court’s actions,” says a senior executive at a data vendor. “The DTCC accepts one and only one identifier for settlement and clearing. Every single trade that is cleared and settled in the US goes through DTCC, which has its ‘relationship’ with Cusip. DTCC, by its actions of only accepting Cusip, means firms still have to subscribe. It’s baked in. You want to trade, settle and clear in the US? DTCC requires a Cusip as part of the order submission.”

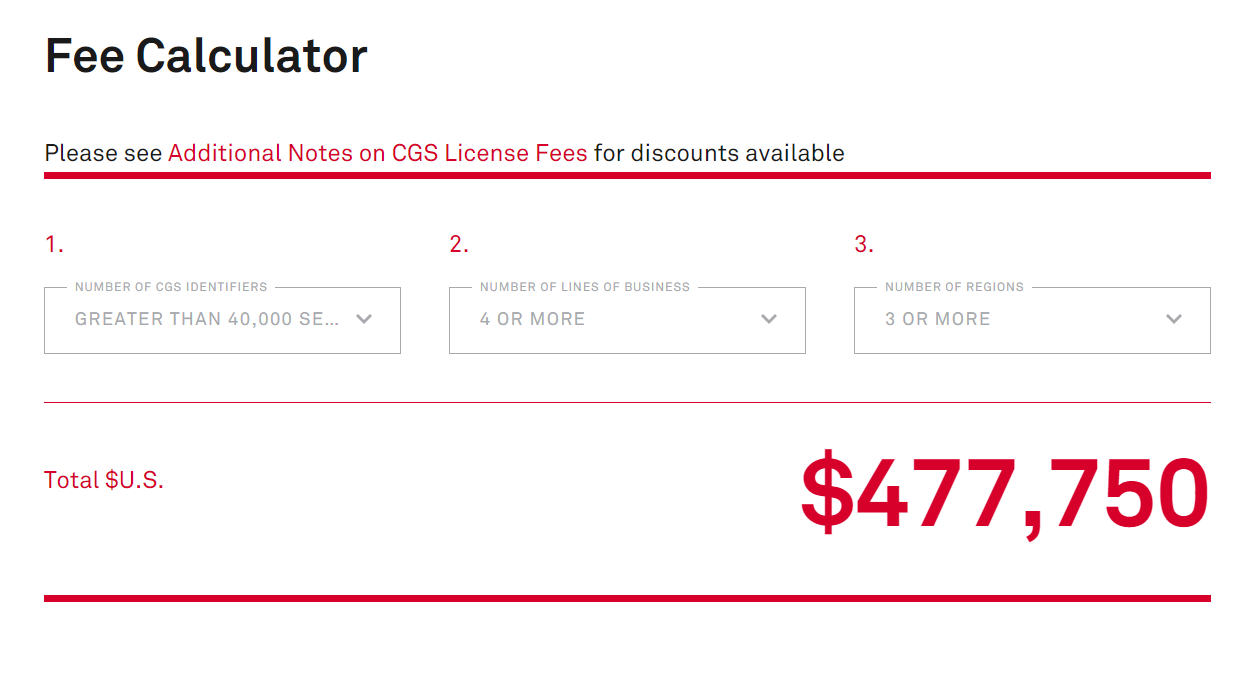

Now, one could also argue that the Cusip was first rolled out in the 1960s and has a track record of reliability. While the cost of buying a Cusip can be hefty (see image below), if it ain’t broke, why fix it? Just fix the cost, some say.

“The big banks pay out so much money for market data, the Cusip license is a rounding error—it’s just a line on a big Excel spreadsheet,” says a data consultant with decades of industry experience. “You talk to smaller firms and small asset managers and fintechs—they all hate it,” because for them, the cost affects their bottom lines more significantly.

Questions abound

I would like to emphasize that over the last few weeks, I repeatedly reached out to the DTCC asking for comment/guidance for this column. The questions I asked have been raised by many of our sources during our coverage of the Cusip case.

Sources have suggested that the DTCC, due to its stature and its stance on Cusips, helps underpin the dominance Cusip enjoys. When I wrote to a DTCC spokesperson, I said that while I would assume the DTCC does not agree that this setup constitutes a monopoly, I still had to ask—do they? No comment.

I also asked, what’s the DTCC’s stance on the Figi? And, has the DTCC made any recent public comments about why it doesn’t use external identifiers other than Cusip? No comment.

I also asked, has the DTCC ever considered expanding beyond Cusip the identifiers it allows to be used in US settlement? No comment.

I even made sure to explain that I thought there could be good, practical reasons to limit settlement to the Cusip standard. Maybe the cost to build out the infrastructure to support an additional identifier for the DTCC and other market participants would be too great. Or perhaps Cusips have proven to be such an effective and easy-to-use identifier, a change isn’t necessary. I also pointed out that the Figi was only authorized for national use 18 months ago, so maybe that wasn’t enough time to get the ball rolling on anything. No comment.

How much effort would be required to support another data standard for US settlement? No comment.

Is there anything I am missing that I should keep in mind as I speak to industry participants for this column? No comment.

Now, I’m not saying that the firms running the Cusip identifier have created a monopoly—that’s for the court to decide. And, to the extent anyone thinks there’s a problem here, I’m also not saying the DTCC should share the blame for it.

But if the DTCC believes in the virtues of open-source, shouldn’t the organization be willing to consider alternatives to Cusip, especially an open-source data standard like Figi? Or, at the bare minimum, shouldn’t it be ready to explain why not? Cusips have been used since the 1960s, but there have been tectonic shifts in technology—from cloud to APIs to open-source to AI and beyond…at what point does it become silly to not re-evaluate the status quo? Shouldn’t such an important industry utility hold up-to-date opinions about identifiers, settlement, and new tech?

I should also state that I’m not shilling for Figi, and, by extension, Bloomberg (which also declined to comment for this column). There are legitimate concerns that the largest banks and asset managers do not want to be tied to Bloomberg even more than they already are today.

“There’s a concern that with Bloomberg, it’s the hook at the end of the line, and at some point, you’ll get further sucked into the Bloomberg ecosystem,” says the consultant. “This is why the Cusip is a good thing—the Cusip, when run properly, should be properly open-licensed.”

There are also concerns that a relatively new open-source tool is not the answer to something as well-established as Cusip—i.e., the banks don’t want a new standard, they just don’t want to have to pay so much to use something that can be found easily on the internet. Individual Cusip codes are readily available on the Securities and Exchange Commission’s website and even from ChatGPT.

There’s a need for a reset around the Cusip. No one wants another identifier; they don’t want anything different. They just want the licensing regime to change—that’s all people want. And that’s all the DTCC wants, because DTCC is probably the biggest policemen of this.

A data consultant

The chief data officer of an asset manager with more than $100 billion in assets under management, for one, thinks it will be the banks themselves that will ultimately develop the alternative.

“When Cusip was acquired by FactSet, [Cusip’s cost and ubiquity] was definitely a concern. Having said that, introducing a new ID is not an easy undertaking for many firms,” they say. “If the prices for its use continue to rise, though, at some point I am sure there will be a consortium of banks who will try to find an alternative.”

Meanwhile, an operations manager at a boutique broker-dealer says that CGS “is like an ethereal vendor—you can’t touch them,” and they lament that they can’t take on other data vendors due to the amount of money they would need to spend on Cusips. They suggest that the Cusip numbering system should actually be run by the DTCC.

“They should be part of the DTCC and as part of the cost of the whole system,” they say. “I think firms just pay it because they always have or were expected to.”

Before the sale to FactSet was reached, sources previously said that the DTCC was a potential suitor for Cusip ownership. The aforementioned consultant says that in a conversation they had with a senior executive at the DTCC, the exec said the utility “couldn’t justify $2 billion,” but the exec agreed the DTCC should be governing Cusips.

“And [they] said DTCC would run it quite differently—they wouldn’t extract excess income from small firms,” the consultant recalls of the conversation. “But it got bought by FactSet, and FactSet is a commercial, listed company, and they bought it because now every potential customer is now a customer of FactSet. It’s a land-and-expand to sell them other things.”

The consultant continues: “There’s a need for a reset around the Cusip. No one wants another identifier; they don’t want anything different. They just want the licensing regime to change—that’s all people want. And that’s all the DTCC wants, because DTCC is probably the biggest policemen of this. They’re essentially the bagmen of the Cusip service, and they definitely don’t like that. It’s not the way they license their data and their products.”

It would be nice to know if the DTCC agrees with this statement.

With the way things are today, and with a potentially disruptive case working its way through the Southern District, these discussions with the DTCC are worth having in the open so industry participants better understand the thinking of the most important players in this space. And I’m also not saying that we’re the outlet where this discussion needs to happen, as we have a small (but I like to think prestigious) readership. The discussion should be happening, and it should involve more than just the likes of Swiss Life, Dinosaur Financial, and the defendants.

If the DTCC believes in open data standards, maybe they should also be more open when it comes to their involvement in the current setup of Cusips in US settlement and clearing. Have thoughts on this, send me a line: anthony.malakian@infopro-digital.com.

With additional reporting by Rebecca Natale

The image accompanying this column is “Replenishing the Ship’s Larder with Codfish off the Newfoundland Coast” by Pavel Petrovich Svinin, courtesy of The Met’s open-access program.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

This Week: JP Morgan, Broadridge, Lloyds, JSE, Schroders, and more

A summary of the latest financial technology news.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: Market data spend and nice-to-have vs. need-to-have decisions

Cost is not the top factor driving the decision to switch data providers. Anthony looks at what’s behind the evolution of spending priorities.

The consolidated tapes are taking shape—but what shape exactly?

With political appetite established on both sides of the Channel, attention is turning to the technical details.