Questions surround buy-side tech consortium Hub

Little has been heard of the company formed by Pimco, Man Group, State Street, IHS Markit, Microsoft, and McKinsey since their announcement in January 2021.

On January 7, 2021, a powerhouse of six large companies—Pimco, Man Group, IHS Markit, State Street, Microsoft and McKinsey—collectively announced they were forming a new company, called Hub. The aim of the collective was to “reimagine” asset management firms’ operating model with a cloud-based platform.

Two-and-a-half years later, the company has relatively little to show for it—at least, not publicly. Sources for this story have either heard mere whispers of what Hub plans to do or close to nothing about it.

But in an interview with WatersTechnology, Hub CEO Paul Taylor says the principle behind the consortium is to provide an optimized operations platform for the investment management industry.

The platform has three overarching pillars for the middle and back offices that solve for data governance and management, trade data ingestion, and real-time position keeping. Beneath that is a library of capabilities that asset managers can choose from. “We know the industry spends about $1 on technology and $3 on people in the operations space. So, how do we implement a solution that over time looks more like 1:1?” Taylor says.

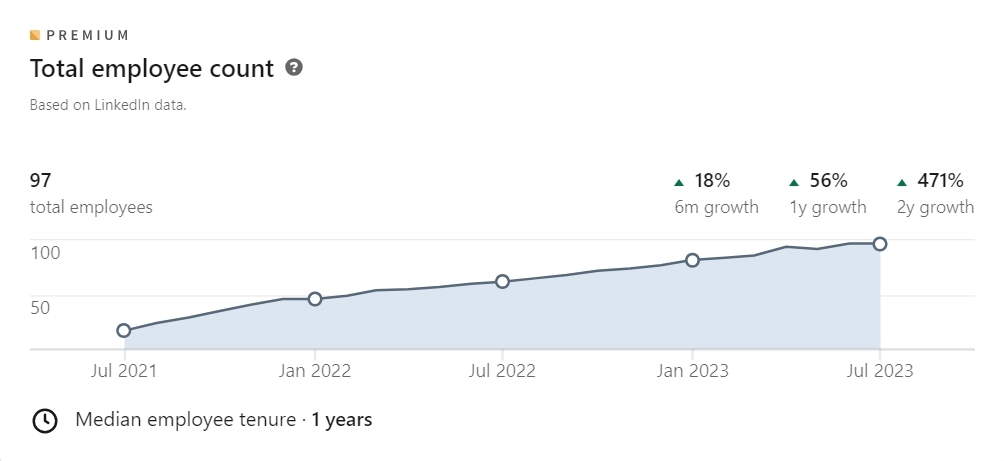

When it comes to that people challenge, Hub is on a hiring spree. According to its LinkedIn page, Hub now has 97 employees, a 471% growth over the past two years. And Hub’s career page shows that it splits roles into four segments: business, technology, product, and customer. Some examples of current roles it is looking to fill include cloud network architects, platform engineers, software engineers, business analysts, and business analysts for reference data.

According to its initial statement, Hub’s greenfield asset management operating platform will be built on the Microsoft Azure cloud and will provide flexible, modular solutions across middle- and back-office functions, while “reducing cost and mitigating risks”. Taylor notes that while the platform has been built with Azure foundation, it can also interact with other cloud structures.

Question marks

Hub’s “data-first approach” will aim to break down silos and friction between systems and data. What exactly that means, though, remains in question.

One source, who has spent more than two decades working in asset management and is familiar with what Hub is up to, says the objective is to build an operating platform for asset managers in the cloud, which is why Microsoft is one of the investors. “There’s been a lot of infrastructure setup to do, but around that will be a state-of-the-art data platform with governance built in,” they say.

The platform is meant to be operating-model agnostic, since asset management firms work with a variety of industry players who have different outsourcing models, vendors, broker connections, and so on. “Hub will just do the plumbing of that,” the source says.

Meanwhile, a head of buy-side solutions at a data management vendor explains that, quite early on, they had some introductory sessions with members of the Hub consortium.

“They did give us an overview of what they were trying to achieve at the time. It was very early stage, essentially the equivalent of a seed round. They were still looking to start the build-out and go to market with their idea around their thesis, which is around revolutionizing middle- and back-office operations.”

But since then, the buy-side solutions head says there have been no further conversations with Hub, or about Hub through clients. “We’re at the direction of clients. We’re platform agnostic; we don’t look to partner with specific folks—we look to standardize feeds. If a client came to us and said they were exploring Hub for some sort of middle-office or back-office augmentation, we would absolutely entertain it and look to partner. But, to date in our client conversations, it has not come up and we have not had any inbound or outbound contact with any members of the consortium.”

A technology and operations specialist with experience of working at buy-side firms reports hearing that Hub has people working very “discreetly” at building its platform somewhere in London.

“One of the outsourcers for Pimco or Man Group were looking for a way to replace their technology, and the way they’re doing that is via this Hub initiative. So, rather than saying, ‘I’m BNY Mellon or State Street and I’ve got this new Alpha platform,’ or whatever, they’re incubating it in a separate fintech company so it’s not going to be subject to all the typical budget cuts that happen in development cycles,” says the specialist.

That’s proved to be a good idea as banks, asset managers, and tech firms have faced layoffs over the last two years. Hub should have protected and given free rein to experiment and innovate in the meanwhile, as its participants prepared to launch. But the technology and operations specialist adds that it’s likely to be well into 2024 before Hub is ready to come to market.

“I can understand that, because if you’re really building something like this from scratch, it takes time. And it takes real conviction that you can do it. You can’t have budget cuts along the way. I’ve witnessed myself over the years that companies have great plans, and then the business cycle kills it because you have to reduce half your developers, half your QA, or whatever it is.”

Another source, a head of managed services at a vendor firm, says there are more questions than answers when it comes to what exactly Hub aims to bring to market.

“The bit I’m trying to work out is, what is this platform? What is the data management aspect? Is it an optimization tool in terms of finding the best, cheapest price from a data vendor and bringing it back into the system and doing that across lots of different vendors? Is it driven by Pimco? Because if it is, it’s got to be more than that. I’m finding it difficult to work out the benefits for people being part of it,” says the head of managed services.

One reason for the delay in any follow-up to its public announcement in 2021 could be down to the nature of consortiums—everyone has to agree on the objectives.

“When I was part of industry consortia, some of them quickly turned into very single-consortium-member beneficial platforms or programs. This meant that a lot of other people went away. So, it’s important to understand who’s directing things. It may have started out as some sort of industry utility product that can be sold to lots of people, but it’s probably rapidly become a very single-member-driven thing, which is why it’s all gone very quiet,” says the head of managed services.

More than 20 other asset management firms and service providers contacted for this story also say they have heard nothing about Hub since the announcement of its formation back in 2021.

Problems, old and new

The operational challenges that asset managers face are not new—they need good quality data that is governed and maintained properly, they need that data to flow easily from one system to another, and the list goes on. All this is required to provide better insights that the front office can potentially use.

Technology providers serving these firms understand and acknowledge that they can no longer work on these challenges alone.

In that vein, Hub is also looking to partner with other tech providers. “Hub doesn’t believe it has to do everything, so we’ve got a partnership ecosystem to help accelerate solving some of these problems as well. … It’s about identifying the spokes that can help solve our customers’ problems faster, rather than us wanting to own absolutely everything, because we’d be on a hiding to nothing if we tried to solve all those problems for all our customers from day one,” Taylor says.

In the two years since its initial announcement, he says the company has successfully built and delivered its platform and is live with its first products in production. He adds that Hub will provide more details and updates on its progress this summer. Taylor declined to provide more detail around Hub’s future plans.

Having owned, managed and operated hedge funds, Taylor has experience in banking, asset management, and technology. Prior to taking on the CEO role at Hub, he was a partner at IHS Markit, running the post-trade processing solution and corporate actions business.

He is one of a few IHS Markit alums that now sit on Hub’s executive team. Nedim Skalonjic, CTO; Pippa Horne, CFO; Andrew Barnett, CDO and chief product officer; Hemant Gupta, head of India; and Sean Elliott, head of customer, all spent time at IHS Markit—or other companies that now sit under the IHS Markit umbrella—which is now owned by S&P Global. The exception is Geoff Galbraith, the firm’s chief innovation officer, who was previously Man Group’s COO.

According to another CEO at a data management firm, there was a “bit of a talent war” when Hub first kicked off. “A couple of people we were interviewing and trying to hire ended up going there.”

Interestingly, this firm has seen Hub in a couple of requests-for-proposals it has participated in. “That has bizarrely been in the data management space, which is sort of their gig and sort of not. I think that’s the thing—people don’t know what it is. There are so many ways a firm can ‘transform’ asset managers’ operating model,” the CEO says.

The idea behind Hub is that data is at the foundation of everything and that asset managers should have that single source of truth for data to drive efficiency.

According to the CEO, this idea has been out there for a couple of decades; the problem is that nobody can tell what it really means.

“Are we talking about infrastructure connectivity? Are we talking about security mastering to allow you to do translation across all the various market data vendors out there? Or are you talking about something else, which is how you connect to multiple custodians and multiple third-party administrators to get your positions and books and records so that you can then build from there to execute in the market? I’m not sure which of those three levels Hub is trying to operate at.”

If Hub was to tackle all these levels simultaneously, it would be “superhuman,” says the CEO, particularly in light of consolidation in the industry towards exchanges, such as Nasdaq’s recent acquisition of Adenza, and Deutsche Börse’s purchase of SimCorp.

“To break into that space is very tricky. They do have the right sort of consortium members to do it, but the expertise required and the agility and the configurability is huge before you can tackle all those problems.”

Operational shake-up?

Innovation in the asset management community has typically lagged compared with the sell side. But increasing regulation, the rise of passive investing, and the continuous need to achieve a consolidated view of data means buy-side firms can no longer take a wait-and-see approach when there’s potential alpha to be gained.

Some see it as a chance to right the wrongs within the industry. Things used to be simple for asset managers, says a former CDO who has spent almost four decades at various asset management firms.

“There was a time when we had integrated investment management systems—the kind that provided a look-through from trading all the way to custody. But then, we didn’t have deregulation, increasing volumes, nor the complexity of the market in the form of other asset classes like with synthetics and derivatives,” the former CDO says.

At the same time, there was more technology available, memory became cheaper, and it was easy to expand and have best-of-breed systems. However, that led to a fragmented tech landscape with a mix of old, in-house systems built specifically for a certain asset class or processes, and slightly newer systems bought from third-party providers.

“And then you’ve got the fact that asset managers now realize they have to pull data together. It’s like a perfect storm where they can’t piece together the data they want easily for regulation or for data analytics. The volume of data needed to get a competitive advantage is increasing. So everyone wants the scalability and the flexibility of that in the cloud, but they have to deal with a huge spaghetti of different systems,” the former CDO says.

Consortium headache

Consortiums are far from a new concept in the capital markets. While there have been a few success stories—think back to the beginnings of Nasdaq, Intercontinental Exchange, Markit, Tradeweb and MarketAxess, to name a few—there have been more blips, particularly those that were formed around blockchain technology.

“Anytime there’s a consortium involved, it’s going to be very slow-moving. The aspirations are usually ambitious, but it’s hard for the underlying institutions to coordinate,” a former CTO of a data and analytics firm tells WatersTechnology.

The head of front-office sales at the same firm points to an analogy.

“Imagine you’re all married, and you decide you want to make your lives interesting but not cheat on your spouses. So, you have a boys club, essentially, and perhaps you get together for a darts night or pool—just a place to let loose. But then one person comes in with a different agenda—say maybe they’re going through a divorce—and that person decides they want to take the group in a different direction. How does that person influence the rest?”

Hub has an interesting mix of companies. There are two buy-side firms, a custodian, a market data provider, a cloud provider, and a consultant. Pimco, Man Group, State Street, IHS Markit, and Microsoft either did not respond to requests for comment or directed WatersTechnology to Hub.

“It’s about analyzing who’s in bed together, and what the motivations of different people are. Everyone comes in and forms a club with the same objectives. But a lot has happened since 2021. Like I mentioned, the one person gets divorced and the objectives change. Same analogy here—what has happened with all these different people that are here together? I think it’s a very noble idea, and I do hope it works and revolutionizes things,” says the head of front-office sales.

The data management CEO says the cases where consortiums don’t work well tend to be where they are steered by one or more firms trying to achieve their own objectives. “When a consortium is left to be independent but well governed, it has a much higher chance of success. The governance structure is very important to consortiums—it’s one of the things where if you get it right, you have a chance; and if you don’t, you really don’t.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

For MarketAxess, portfolio trading buoys flat revenue in Q3

The vendor is betting on new platforms like X-Pro and Adaptive Auto-X, which helped forge a record quarter for platform usage.

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

Nasdaq says SaaS business now makes up 37% of revenues

The exchange operator’s Q3 earnings bring the Adenza and Verafin acquisitions center stage.

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

BlackRock forecasts return to fixed income amid efforts to electronify market

The world's largest asset manager expects bond markets to make headway once rates settle.