Outsourced trading sees uptick as buy side seeks more bang for its buck

Buy-side firms see outsourced trading as a way to simplify their operating model, while custodians see an opportunity to sell bundled services.

Need to know

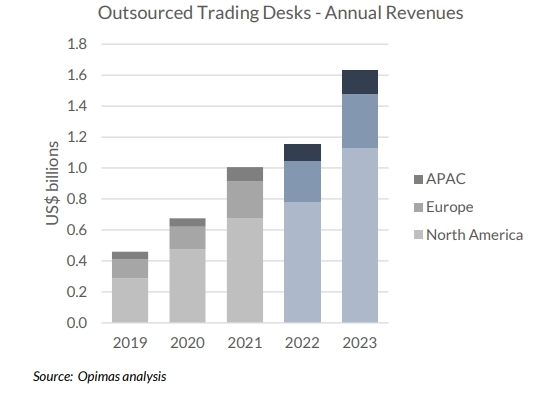

- Outsourced trading revenue has doubled in the past four years and is expected to hit $1.7 billion in 2023.

- Recent vendor activity in the space indicates the sentiment for potential growth.

- Some asset managers believe in maintaining the line of sight between a portfolio manager and a trader.

- Outsourced trading could be a better solution for small- to mid-sized asset managers, while the conversation for larger and specialist firms is more nuanced.

The investment management industry is going through some big changes. Whether they are re-evaluating and trying to better their data management structures, migrating certain functions to the cloud, or using artificial intelligence to improve their analytics capabilities, all these efforts are focused on streamlining their operating models and increasing margins, particularly as cost and other external pressures pile on.

As the buy side continues to outsource more operations to third-party providers, it would appear that trading itself is on the docket, too.

Capital markets consultancy firm Opimas expects revenue for outsourced trading to reach just under $1.7 billion by the end of this year. The report notes that growth would come mostly from larger asset managers seeking to outsource part of their trading activity and right-size their trading desks.

The trading function is one that traditional portfolio managers would have typically done themselves. But as trading has become more specialized and regulated, it has made firms question whether keeping the trading function in-house adds any value—and if it does, how much?

This is one of the many questions that firms need to consider. Another is which of the few outsourcing models they should select before taking the plunge and offloading the execution function.

However, one head of Asia-Pacific at an asset management firm dealing with $800 billion in assets under management believes it’s a recipe for disaster unless the outsourced trading provider has a clear line of sight to everything the firm does.

“An example would be: you have $1 billion of assets in your Japanese book, and your current hedges are $800 million. So you’ve got a $200 million net amount to hedge, but you need to know what hedge you want them to do—is it six months, three months, or five years? You need to be smart enough to figure out what your net exposure is, and then what tenor of hedge you need to do given all the other hedges, which is really an in-house view,” the executive says.

Once the trader figures out that specific hedge, the next step is to email the outsourced trading firm and say, “Please execute this trade.”

“Why don’t you just phone up the bank yourself? What’s the difference sending an email to them, or an email to Standard Chartered to do the trade? Actually, if a trade is so complicated, you might want to outsource that so if it blows up, you can say ‘Well, it’s not my fault.’ Sure, the company still loses money, but then you get to claim plausible deniability,” says the executive.

But that doesn’t mean that outsourced trading is dying out. Revenue for the outsourced trading market has doubled over the past four years, from less than $500 million in 2019 to breaking the $1 billion mark in 2021, according to data from Opimas.

John Marsland, now an independent consultant—who previously led the group trading function at Schroders in London, where he was also COO of the firm’s investment division—says asset managers are interested in outsourced trading for several reasons.

“Well, perhaps you don’t want to pay for more traders—experienced traders are expensive. Heads of trading are even more expensive. But actually, they do lots of other things apart from trade. Who’s going to be responsible for your best execution process? Are you actually going to be able to reduce your trading team? Are you just not growing or scaling your trading team to cope with increased demand? Are you replacing traders or junior traders with outsourced trading? By how much? A trading desk is quite expensive to run, and a lot of that cost is around governance and systems,” he says. (see box: ‘The complexities of best execution’)

In most cases, the conversation is not about whether to fully outsource trading or keep all trading in house. Instead, it is about introducing outsourced trading as an option. “Unless you can actually replace experienced people or systems with this outsourced trading capability, you’re not going to save any money,” he adds.

Before attempting to disentangle the question of whether asset managers are for or against outsourced trading, it’s worth establishing the different types of outsourced trading providers.

Story continues after BOX

The complexities of best execution

Best execution has often been the subject of discourse, and the industry saw a lot of that through Mifid II regulation, which requires firms to prove best execution. The Securities Exchange Commission’s (SEC) proposal for new regulation for best execution has also been met with feedback by the broker-dealer community calling the proposal “onerous,” “superfluous,” “unreasonable,” and “the definition of arbitrary, capricious action.”

John Marsland, now an independent consultant—who previously led the Group Trading function at Schroders in London where he was also COO of the Investment division—says that when you run a trading team, there are effectively two sets of regulations at the front of your mind.

First, the trading team has to treat clients fairly and responsibly, which means getting equal access to liquidity. “It’s very difficult to do that unless you control that centrally. If you have firm capital at work—as in your own seed capital in funds—then you have to make sure that money goes last in the queue to the liquidity, meaning that all clients have been satisfied before your own firm’s capital,” he says.

The other big competing responsibility a head of trading has is best execution—and this is where it gets more complicated because best execution is “quite a complex thing” and doesn’t necessarily mean that the trader goes to multiple brokers for a quote or simply chooses between brokers and algorithms.

This is perhaps where the independent outsourced trading providers could come off better, as this model does not have conflicts of interest that may arise from other business lines, such as in the prime broker and custody models.

“Broker neutrality is key to the business model,” Raymond McCabe, founder of independent provider Outset Global.

That said, State Street and Northern Trust use transaction cost analysis (TCA) to prove best execution.

State Street has its own TCA business, which it bolstered in 2018 with the acquisition of foreign exchange TCA business BestX. James Woodward, Apac head of portfolio solutions at State Street, says BestX has been fully integrated and has added fixed income and exchange-traded derivatives to create a multi-asset class TCA service.

Meanwhile, Stephanie Farrell, head of integrated trading solutions at Northern Trust, believes in using several third-party providers, as TCA should be unbiased and neutral to clients.

While measuring market impact with data and analytics is how firms “prove” best execution, Marsland says, “You can prove almost anything with TCA data—it’s not very accurate data. It’s also very opinionated, model-based data, and there’s not a lot else to compare it against, apart from other clients for the same TCA data, so you need to be careful,” he says.

For example, comparing a larger firm that manages tens of billions in European equity strategies with a firm that manages $1 billion or $100 million in Europe would not make sense. They are both going to get different market impact results, which makes best execution “incredibly subjective.”

Instead, he says best execution numbers are best used to understand if—and how—the trading team is improving its processes, liquidity access, and the way it sends trades to algorithms.

Different models

There are broadly three types of outsourced trading providers: independents, prime brokers, and custodians.

Independents are pure outsourced trading providers that don’t offer any other services and therefore are known to provide the least conflict of interest. Some examples of independents include Outset Global and Tourmaline.

Those that provide outsourced trading in the prime brokerage group are typically prime broker subsidiaries. These firms can offer supplementary services such as research and capital introduction. Some examples of these firms include the likes of TD Cowen, UBS, BTIG, and Jefferies. TD Cowen declined to comment on this story, as it may soon have a new owner.

Meanwhile, the appeal of outsourced trading providers under the custodian umbrella is that a firm could elect to include other services, like custody, post-trade processing, fund accounting, and so on, and essentially bundle those services under one provider. Examples include Northern Trust and State Street.

Interestingly, there’s been another entrant into the outsourced trading provider space that doesn’t really fit into the former three buckets. In January, BNY Mellon announced a new outsourced trading offering for buy-side firms, backed by xBK, BNY Mellon’s buy-side trading division that executes over $1 trillion in volumes annually for the firm’s investment management arm—a $1.8 trillion business.

Dragan Skoko, now head of xBK and outsourced trading at BNY Mellon, was previously the head of trading and trade analytics at xBK in 2018. He tells WatersTechnology that xBK is the result of a 2018 decision to consolidate three of the firm’s trading desks, prompted by the same challenge facing many buy-side firms: maintaining multiple side-by-side trading desks with their own technology stacks and heads of trading.

“The idea was to take those three legacy desks and combine them into a single trading organization and essentially create a vision for the future state of what centralized trading will look like for us, and to build a platform and a framework that scales and takes away some of those challenges we identified,” he says.

The consolidation of the three desks led to BNY Mellon retiring 11 legacy trading platforms. It partnered with a vendor and took two years to turn that solution into an all-asset execution management platform. (see box: ‘Retiring platforms’)

Skoko believes this will be a differentiator for BNY Mellon’s offering, as even internally, it has improved scale by five times. “If we could do one order from the beginning, now we can do five. If we could do a million, we can do five million orders in a day. It improved our post-trade processes as well,” he says.

Part of that process involved building a proprietary data management platform using open-source tools to ingest “enhanced” real-time streaming data. Then, it added a data science team—adding quantitative modeling and analytics capabilities—to help generate actionable trading insights.

To do that, traders have to understand their transactional data, the investment objectives of the portfolio managers and strategies, and the execution strategies that support those objectives.

“The first foundation to getting there is a data management platform that can support deep time-series datasets that also plays nicely with your research environment. We’re talking about high-frequency data,” he says.

It also streams datafeeds from dealers onto its platform, and in terms of analytics, Skoko says the platform consumes data on between 20,000 and 30,000 securities every day.

“As is often the case with BNY Mellon, we ‘ate our own cooking,’ and thought our clients could use some of this too,” he says.

Independent consultant Marsland says this approach is interesting because it is a pure buy-side trading function. “They’ve taken their trading teams from their own brand asset managers, and put them together into a single execution team potentially offering the same service to external asset management firms as they do their own fund managers. The right questions here would be to satisfy yourself about how they treat customers (internal and external) fairly and give equal access to liquidity,” he says.

Like a few other outsourced trading providers, BNY Mellon offers full and partial outsourcing solutions.

Full outsourcing is where a buy-side firm deals with everything from research, portfolio construction, security selection, and order creation, then hands off trade execution—execution strategy, selection of access methods, and management of counterparties—to a third party.

Meanwhile, partial outsourcing, also known as hybrid outsourcing, is where an outsourced trading provider supplements a buy-side firm’s existing trading capabilities. For example, a buy-side firm may want coverage of additional time zones, or could be expanding into a new asset class for which it doesn’t have sufficient expertise in-house.

“One catalyst for outsourced trading is that the need for line of sight between a PM and a trader has simply gone away for a couple of reasons. One, we’ve been in a hybrid environment for three years and most firms have decided they’re not going back to a full office environment,” Skoko says.

The second reason is that technology has also improved, meaning that there’s more transparency into potential trading outcomes, and that traders and PMs are getting more comfortable with technology and communication tools, he adds.

In addition to its outsourced trading offering, clients will also have access to BNY Mellon’s portfolio of front-, middle-, and back-office services.

Reaching into the front-office

This is adjacent to what Northern Trust and State Street also offer. Since starting its own outsourced trading service in 2017—dubbed Integrated Trading Solutions, which has 30 traders on desks located in Chicago, New York, London, and Sydney—Northern Trust realized it could extend its agency trading model and tap into the company’s ecosystem of products and services. Apart from trade execution, that includes downstream processes like trade settlement and foreign exchange services.

Stephanie Farrell, head of the Integrated Trading Solutions business, says that while regulation and increasing costs were the “bedrocks” of what brought outsourcing to the forefront, asset managers are now also pursuing it for scale and efficiency.

She adds that Northern Trust takes a holistic view of the investment manager lifecycle, and therefore prioritizes investments that aid idea generation for the front office, which she believes helps the firm stand out among other outsourced trading providers.

This is where Northern Trust’s Investment Data Science unit—which combines services from Equity Data Science, Essentia Analytics, and Venn by Two Sigma—comes in.

“We want to give our clients those tools to improve their performance to have behavioral analytics tools that are assisting with that idea generation, and then sending that all the way through down to trade execution and expressing those views into the market, just taking it one step ahead of the trade hitting us,” she says.

This will allow clients to optimize their operating models across the entire trade lifecycle—from idea generation to trade settlement—and allow firms to leverage more of their relationships with Northern Trust.

Farrell explains that typically, the execution management system (EMS) sits within the outsourced trading provider and is linked via Fix to the client’s order management system (OMS). Northern Trust’s EMSs—it uses FlexTrade for equities and Bloomberg’s Toms for fixed income execution—are OMS-agnostic, so they can connect to various OMSs.

Then, for TCA, the firm uses several third-party vendors to ensure it provides unbiased and neutral TCA to clients. Northern Trust offers outsourced trading for equities, fixed income, and listed options, and has recently expanded into European derivatives.

Typical client profiles include established long-only investment managers. Northern Trust also works with some startup funds and hedge funds, as well as several public funds. “The real focus has been around some of that legacy infrastructure and working with clients to redesign and optimize their existing structure,” she says.

Farrell adds that the majority of clients contract for a fully outsourced model, where they have shifted their in-house desk to Northern Trust. In some cases, Northern Trust has hired traders from those firms, so it retains talent that still works closely and trades directly for those managers.

It also augments some clients’ trading that opts for partial outsourcing. “A US-domiciled investment manager is using us for that overnight business in Apac and Emea, so they don’t have to have staff 24/6 or have local market presence,” she says. However, she stresses that the foundation of Northern Trust’s offering is that “holistic full outsourcing” model.

Alpha at the core

Meanwhile, State Street, another custodian offering outsourced trading, along with other services, is banking on its State Street Alpha offering—its front-to-back office investment and data management platform—to differentiate itself from other providers in the space.

State Street Alpha helps buy-side clients manage their investment products and businesses in one place, providing data analytics and real-time insights. At the heart of State Street Alpha is the Charles River EMS, which connects to the middle and back offices.

According to James Woodward, Apac head of portfolio solutions at State Street, the firm also provides agency execution with access to more than 140 counterparties and liquidity venues. It offers trading in equities, fixed income, exchange-traded derivatives, and foreign exchange in global developed, emerging, and frontier markets.

“When we’re talking to customers, we can have a conversation about order management, portfolio management in terms of Charles River, and then we can have discussions about middle-office services [such as] how we can create them an Ibor, and manage their middle-office environment. And then we can talk about downstream in terms of providing custody services,” Woodward says.

While explaining that firms don’t necessarily need to take on all those other services; they are modular and interoperable. “We can sit with a client to see where their needs and pain points are and then come up with a customized solution for them,” he says.

On its outsourced trading solution, State Street announced in March 2023 that it is acquiring CF Global—an independent outsourced trading provider—to bolster and expand its own capabilities.

The acquisition will extend State Street’s coverage to include UK and Europe, markets where Woodward says outsourced trading is maturing the fastest. He believes a key advantage of any outsourced trading firm lies in its trading team and expertise.

“When I look at CF Global, I think they’ve got a fantastic team—they’ve spent 20-plus years servicing and providing execution solutions, and specifically on outsourcing trading, not anything else. They’re very focused on outsourced trading to a wide range of customers,” he adds.

The question this deal brings is: how independently can CF Global continue to operate? Independent consultant Marsland says State Street will have to answer some questions on how the outsourced trading service will operate once integrated into the broader State Street enterprise.

“For example, to what extent are you relying on internal liquidity and internal algorithms compared to the full market. One would assume that the information doesn’t leak into the broader trading team. But you are relying on their internal information barriers to make sure that doesn’t happen. Also, what happens to your data, and how is it shared or pooled with others. These are the sorts of questions you should be asking and satisfying yourself about,” he says.

State Street has a team of about 20 traders, but when the CF Global deal closes—by the end of 2023—that number will more than double with the addition of CF’s team of 30 traders.

Marsland says asset managers are looking to create efficiencies and are discovering where their core strengths lie, which is why more are looking toward outsourcing certain elements of their business, like trading. And even outsourced trading can be divided into different elements: it doesn’t have to be everything, he says—it can be hybrid, modular, on-demand, or business continuity planning.

For example, perhaps an asset owner who is internalizing their fund management is starting from scratch in terms of establishing an investment management capability and sourcing liquidity. Another use case could be for business continuity and resiliency, such as to bolster resources during periods of staff sickness, holidays or departures, State Street’s Woodward adds.

“In a situation where the trader suddenly disappears for whatever reason, then the portfolio manager may need to step in and route that to a particular broker. That would be as part of their BCP process. But some of these things take time, the PM may not have time to speak to brokers to find liquidity. It may also not be his area of expertise, he may be a stock picker, not a trader. That’s a situation where I think outsourced trading can add real value,” he says.

It is also harder to find staff these days, Woodward says. So, if a trader leaves, an outsourced trading desk can step in and fill that gap, perhaps until the firm finds the right candidate that’s a good fit for the firm.

To strengthen the best execution component of its offering, in 2018, State Street bought BestX, a firm that initially provided TCA for foreign exchange. Woodward says that business has been integrated with State Street’s existing TCA business and has since added fixed income and exchange-traded derivatives coverage to create a multi-asset class TCA service.

But this is what some asset management firms believe adds “conflict” in outsourced trading solutions and therefore leads some to partner with independent providers.

The path of least conflict

One example is Smead Capital, a Phoenix, Arizona-based $5 billion hedge fund that started in 2007, which has outsourced its trading function to Outset Global.

Cole Smead, CEO and portfolio manager at Smead Capital, tells WatersTechnology that it chose to outsource its trading to Outset Global to create operational efficiencies, increase cost synergies, gain better market knowledge, and, most importantly, it was the option that presented the least amount of conflict.

“Who has the least amount of conflict? I think that was a big idea in our mind, and we felt the least conflicted with Outset,” he says.

For example, in the broker model, most have desks that do agency trading, or principal. The problem, according to Smead, is the “magical wall” inside the broker-dealer that keeps the outsourced trading arm completely independent.

“It just doesn’t stand up. As an example, in talking with Outset, one of the questions we asked was, ‘Do you ever cross trades in house?’ That is to say, if they had one buy-side client, dealing with another, do they ever cross trades in house? And the answer is, no—they don’t do that. You would find cross trades inside of an agency desk that also has an outsourced trading desk. I think it’d be common, whether you know that or not,” he says.

That’s why Smead Capital decided to outsource its trading to Outset Global—it was the least conflicted model.

Raymond McCabe founded Outset Global in February 2012. He started his trading career in the early 1990s as a trader and senior market maker in several investment banks, including JP Morgan. He also had a three-year stint at CF Global, heading up their European trading.

He explains that Outset Global operates solely as a buy-side trading desk and doesn’t offer any “teaser services” to capture a fund’s trading. It operates in a ‘no conflict’ environment, in the sense that it does not cross stock, shop client flows, or have any proprietary trading. The firm has offices in Hong Kong, London and New York, and 240 sell-side broker relationships globally. It covers equities globally, has a US-listed derivatives business, has also started to trade corporate bonds, and will continue extending its business according to client demands.

He adds that more than 40% of new revenue in 2022 came from clients previously using a prime broker or custodian trading service. McCabe says with Outset Global, investment managers have greater visibility into the trading process and can monitor execution quality independently.

For Smead Capital, Outset created a mirror system of Outset’s real-time trade blotter on the firm’s Bloomberg terminals, so it feels as though it’s being done in-house.

“We’re watching that as a team. If we see something that we don’t like, or we find out it’s moving slower than expected, or something of that nature, we’re interacting with Outset on Bloomberg IB chat and talking about it with them. Or they’re already being proactive to say, ‘Hey, we’re having trouble on a trade, or it isn’t moving very quickly,’” Smead says.

He adds that outsourced trading made sense for Smead Capital, particularly due to its low turnover discipline of 25% or less, and it doesn’t trade much outside client flows. “That would just be hell for a buy-side trader,” he says.

The other issue was it was going to be expensive. Smead Capital had assumed the fixed costs for one trader and the systems to support the trader would be far north of $400,000.

Also, a buy-side trader would need in-depth market knowledge, usually learned through years of experience in the markets. For Smead Capital, this supported the case for outsourced trading even further. “In our case, Outset Global may deal with other clients that might be a lot more active than us—they know more about the markets. That’s a good thing for us, versus using our low turnover and strategies—you’re not going to learn very much about the market,” Smead says.

A peek into the future

While there will be asset managers that are adamant about keeping trading in-house, the sentiment for outsourced trading continues to grow, as showcased by the Opimas report, as well as activity in the space exemplified by State Street’s acquisition of CF Global and BNY Mellon opening its buy-side trading desk to clients.

“It validates our belief that outsourced trading is a unique opportunity to impact the quality of trade execution in many ways,” Outset Global’s McCabe says.

When choosing between the various outsourced trading models, a buy-side firm will choose the option that provides the most value for the investor. If a firm’s portfolio turnover is 100% or greater, Smead says it’s possible that’s where the firm can add more value in their trading.

“That’s the places that are probably going to keep their trading in-house versus lower turnover strategies, where I think trading matters less—it’s the quality of what you do for the investor. When it’s not what you trade, but what you own, and that’s where I think you’ll see a lot more outsourcing,” he says.

As asset managers look for ways to further simplify their operating models in the quest for higher margins, outsourced trading is one option.

According to Marsland, looking at an asset manager’s value chain or operating model, one of the most complicated interfaces is between trading and the middle office. “If you can outsource your trading and implementation, you could simplify your operational platform dramatically. You could potentially get rid of a significant percentage of your entire investment operating model,” he says.

To provide a simpler operating model for asset managers, providers will need the middle office, the data capability, and the trading capabilities to operate together—sort of a tripartite effect, he adds.

“You need all three working closely together and potentially by the same organization. Is it just a coincidence that those same three asset servicing trends are the three things at the moment that everybody’s trying to push?” he says.

To his earlier point, traders—especially heads of trading—are expensive if outsourced traders can either augment or replace and pass on their expertise—including best practices around governance—it will be a better solution for smaller or even mid-sized firms.

“For the larger and specialist firms it’s a much more nuanced conversation until you can make the case for full outsourcing of trading or even implementation,” he says.

Retiring platforms

Technological change is always challenging. Switching a platform off involves conviction and a lot of gut. But through its consolidation project, BNY Mellon successfully retired 11 platforms within its investment management business.

Dragan Skoko, head of xBK and outsourced trading at BNY Mellon, tells WatersTechnology that the firm first started with a vision for what it wanted trading to look like and what execution framework it needed to support that.

BNY Mellon portfolio managers trade in 55 equity markets, 110 fixed income markets, listed and OTC derivatives, and foreign exchange.

“We realized that none of the legacy platforms could accommodate for that vision. So we went through a phased process. First, we moved our fixed income and FX trading onto the new platform, then we moved our equity trading—active equity then index equity—and then eventually our derivatives trading,” he says.

On top of that, BNY Mellon also built decision support tools and recommendation systems—using its xStar execution framework—that will allow traders to make decisions consistently and at scale. The firm also injected data science capabilities to bolster xBK’s capabilities.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.