CME-Google cloud partnership already yielding new data analytics

CME is spending a small fortune to migrate its technology to Google’s cloud, betting on the cloud’s ability to return a large fortune from development of new data products and services.

CME Group will spend $60 million this year as part of its ongoing project with Google to migrate key parts of the exchange’s infrastructure to the cloud. But the effort is already paying off, as officials say using Google’s cloud platform has already enabled CME to develop new data and analytics products faster than it would have been able to do with traditional technology.

“Being able to get our data onto Google Cloud has allowed us to accelerate the development of products in our data business, including new analytics,” said Julie Winkler, CME’s chief commercial officer, speaking during the exchange’s Q2 earnings call earlier today.

For example, using the cloud has already allowed CME to create completely new execution analytics tool that allows the exchange to share benchmark execution data with customers to help them better manage their trading. CME put the new analytics into production earlier this month, and will begin sharing them with clients soon, Winkler said.

“The speed and efficiency of having the cloud behind us is enabling that new development in our data business,” Winkler added, while also providing greater flexibility around how the exchange can package and deliver data, and make it more accessible to clients who don’t directly access CME’s market data today.

The exchange’s data business, along with its clearing arm, are the first divisions to migrate to Google’s cloud, under a 10-year partnership to transition CME’s infrastructure into the cloud. Among the key aims of the migration were that “Google Cloud’s data analytics and machine-learning solutions will help CME Group provide clients with on-demand information and toolkits for developing models, algorithms, and real-time risk management,” and to “co-innovate new products, such as risk mitigation tools, analytics, services and user-centric platforms”—which the exchange is making good on with today’s announcements. As part of the deal—announced in November 2021—Google also took a $1 billion stake in the exchange. After that, more announcements followed: Nasdaq and Amazon Web Services announced a similar collaboration, followed by the London Stock Exchange Group’s tie-up with Microsoft.

Exchanges all see potential to do much more in the cloud than they’ve traditionally been able to alone. But it will take time before these new product developments enabled by Google Cloud translate to subscription sales and can demonstrate their impact on the exchange’s bottom line. For Q2, the exchange’s market data business generated revenues of $163 million, up 8% over Q2 last year, but down $2.7 million over the first quarter this year, when revenues included some $4 million in audit recoveries and “catch-up” payments, which only accounted for about $500,000 in Q2.

Using the cloud to more rapidly develop new capabilities may also reduce CME’s need to pursue M&A deals to fill gaps in its technology or data offering, since it will be able to build products in house with shorter development schedules and time-to-market deadlines, allowing it to be more responsive to changing trends.

“Our Google transaction will allow us to do things that our competitors can’t,” so the exchange won’t need to buy other companies if it can develop the same capabilities faster in-house, said CME chairman and CEO Terry Duffy.

“We don’t necessarily need to do M&A, but we’re not going to shy away from it when it makes sense,” Duffy said. “We are in a very strong competitive position if a good M&A opportunity comes our way,” he added, referring to the fact that CME has about $2 billion cash in the bank and that a lot of potential acquisitions are heavily leveraged.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

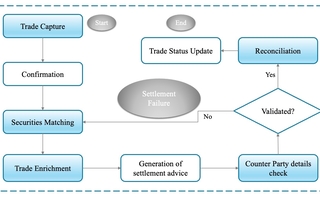

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.