A fully cloud-hosted exchange is coming—but for now, one piece at a time

Execs from Google, LSEG and NYSE discuss how exchanges are beginning to leverage the true potential of the cloud.

While it won’t happen this year, the day could come when every aspect of an exchange’s operations will be hosted entirely in the public cloud cloud—but industry experts say that day is still some way off.

Exchanges have been migrating components of their business into the cloud over the last few years. And despite some high-profile alliances between exchanges and cloud vendors, exchanges seem to be hedging their bets and working with multiple providers, depending on which best meets the needs of the particular function being offloaded.

For example, late last year, the London Stock Exchange Group (LSEG) announced a 10-year partnership with Microsoft that will see the exchange migrate its data platform and “other key technology infrastructure” to Microsoft’s Azure cloud environment.

David Shalders, COO and head of integration at LSEG, who was speaking on Tuesday at the North American Financial Information Summit (Nafis), hosted by WatersTechnology in New York, said the exchange is “very proud of our relationship with Microsoft,” but noted that the exchange also stores trade data in Google’s cloud, and runs some post-trade functions using Amazon Web Services (AWS).

Other notable exchange–cloud tie-ups include CME Group and Google, which announced a 10-year deal in November 2021 to move the exchange’s technology infrastructure to Google Cloud, starting with its data and clearing services. As part of that agreement, Google also took a $1 billion stake in CME. Shortly after that, Nasdaq and AWS announced a similar deal (minus any investment by AWS) to migrate the exchange’s infrastructure to the cloud. Nasdaq and AWS already operated a cloud partnership—which, among other things, included AWS running the underlying infrastructure for Nasdaq’s proprietary FinQloud service, which the exchange shuttered in 2014 and migrated the client base to AWS.

Notably, Intercontinental Exchange (ICE) has not announced any major cloud partnerships to date, though its New York Stock Exchange (Nyse) subsidiary migrated its surveillance platform to a combination of Snowflake and AWS around three years ago, said Anthony Zawadzki, head of proprietary data at Nyse, who also spoke at Nafis.

Sometimes our download speeds were seven to eight hours—and that’s not ideal, cutting it so fine to market open. Once we cut over to the cloud, those download speeds went down to around one hour. That gives customers more time to prepare for market open.

Anthony Zawadzki, Nyse

“Intercontinental Exchange runs its own global network, so we’ve had that capability in-house to get data anywhere in the world. Our CFO calls it our own private cloud,” Zawadzki said. “But we incorporate cloud where it makes sense. … So, if customers want data on AWS, Azure, etcetera, we’ll meet the customer where they want to be.”

In addition, around two years ago, Nyse moved its historical data onto the AWS cloud, which paid dividends during the volatility experienced during the Covid-19 pandemic. Greater volatility and trading activity meant that trade data files were much larger than usual, and—before switching to AWS—took longer for clients to download overnight.

“Sometimes our download speeds were seven to eight hours—and that’s not ideal, cutting it so fine to market open. Once we cut over to the cloud, those download speeds went down to around one hour. That gives customers more time to prepare for market open,” Zawadzki said.

Aside from storing large volumes of trade and historical data, exchanges are using the cloud to spin up infrastructure on demand to support new initiatives or to cope with unexpected bursts of volume in the markets, without having to buy new hardware or reassign capacity on existing resources.

“One of the benefits of the cloud is that … a lot of the operational overhead is abstracted away, and technologists can focus on what they do best, which shortens time-to-value, and allows us to better serve clients,” Zawadzki said.

Cloud advocates say that maintaining in-house resources is wasteful and expensive, because firms need to have sufficient capacity to handle unexpected volume peaks. Still, these peaks are rare events, added Aaron Walters, a 13-year veteran of data and technology roles at CME Group, who now heads exchange and ecosystem strategy at Google.

“So, you have 70% of your capital expenditure just sitting around doing nothing while you’re waiting for another peak load,” he said. “It doesn’t matter if it’s 5-times or 10-times normal volumes, because cloud can scale way ahead of that. There is a point where [on-premises hardware] just does not work and where what we’ve all done for the last 20 years needs to get flipped.”

However, there are still many areas where the cloud isn’t quite ready to replace on-premises solutions. For example, how cloud environments manage latency issues means that migrating core exchange matching engines may be some way off.

“I don’t expect to have a matching engine fully in the cloud within a year, though the cloud providers are trying to crack that,” Zawadzki said. “One of the most important things for trading customers is the determinism—ensuring that they’ll get the same latency time after time. And one of the things we see from on-premises is relatively consistent determinism. So, in terms of migrating our core exchange technology, in the near-term, we think it’s not quite there yet.”

LSEG’s Shalders agreed, but presented an even bigger vision for the future: “I think a totally digital exchange—where you can do anything, anywhere, at any time—is coming, but is still a long way off.”

In the meantime, exchanges and cloud providers will continue to migrate exchange operations to the cloud one at a time, and over the term of those decade-long deals, can also start to leverage the interoperability and potential of enterprise software suites—such as Microsoft 365, which is a large component of the LSEG–Microsoft deal, or even Google’s suite of free apps, should the vendor be so inclined to target financial professionals with those—with other new technologies to change the way that the markets interact with exchanges and data.

“With the interoperability of Microsoft 365, large language models, and other things, the workflow of professionals could change dramatically,” Shalders said.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

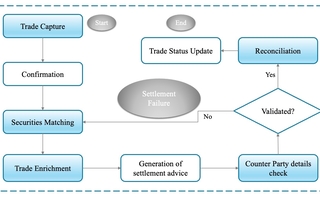

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.