This Week: Ice, SS&C/Morningstar, Deutsche Börse/DataBP, RBC & More

A summary of the latest financial technology news.

Ice Clear Credit expands services to include JP Morgan

Intercontinental Exchange (Ice), a data and market infrastructure provider, will now be offering clearing services for client-executed Credit Default Swap (CDS) index options through Ice’s Clear Credit offering. Clients of JP Morgan will now be offered clearing services for CDS index options through Ice.

Ice’s clearing house offering, Clear Credit, intends to support the clearing of CDS index option instruments, referencing North American and European corporate indices.

This is to provide end-users with the opportunity to add cleared CDS index options to their risk management strategies.

Launched in 2009, Ice’s Clear Credit solutions work to offer clearing for single name and index CDS instruments based on corporate and sovereign debt and to reduce counterparty risk exposure.

SS&C partners with Morngingstar’s Sustainalytics for ESG

SS&C, a financial technology solutions provider, will integrate Morningstar’s Sustainalytics environmental, social, and governance (ESG) data into its Advent platforms to support portfolio management and analytics workflows.

Sustainalytics is a Morningstar company that specializes in providing research and analytics into ESG data, to strengthen the portfolio analytics experience for a firm’s front and middle offices.

Through this integration, SS&C’s clients could be able to align investor values with ESG-focused investment styles, and pair Advent’s portfolio data with ESG data for enhanced insight into internal management and client communications.

The Sustainalytics ESG data integration will be made available to clients onboarded onto SS&C Advent’s cloud-based Genesis Platform in the second half of 2022.

Deutsche Börse Group partners with DataBP to digitize market data licensing

Deutsche Börse Group has entered a partnership with data licensing and subscription management platform provider, DataBP, to implement a digital data licensing and management platform.

Through this collaboration, Deutsche Börse intends to streamline business operations and optimize customer experience for its Market Data + Services (MD+S) business.

Additionally, Deutsche Börse aims to leverage DataBP’s data management capabilities and resources to support and maintain its client relationships which operate at a high level of diversity and scale.

Following the partnership, Deutsche Börse has released new features which intend to allow their clients to more easily navigate their data licensing and subscriptions within its online contract management portal, MD+S Interactive, which is based on DataBP’s platform.

RBC Clearing and Custody launches new unified technology platform

Royal Bank of Canada (RBC) has launched a new unified technology platform and secure entry point, called RBC Nexus.

The platform, which was brought into existence by RBC’s Clearing and Custody division, has been designed for all independent broker-dealers and registered investment advisors. Users of Nexus can access RBC Clearing and Custody’s full portfolio of tech tools in one place.

Nexus works to eliminate the need for financial professionals to access multiple applications or manage integrations. The platform’s main purpose is to help users manage their client relationships and operate their book of business.

RBC’s new device and OS-agnostic platform also enables users’ direct access to another RBC platform, RBC Black.

NowCM and Liquidnet look to launch new issue workflow

NowCM, a digital solution and infrastructure provider for the primary debt markets, is working with Liquidnet to launch a new issue workflow. NowCM and Liquidnet’s collaborative offering has just undergone its first simulation of a deal origination and order submission.

The simulation also pulled together the assistance of two dealer banks, a transaction counsel, and a European frequent issuer, to deliver the real-time production and negotiation of a set of transaction documentation in both English and German on NowCM’s documentation platform.

The collaboration between the two companies can be seen through Liquidnet’s primary market workflow tools being shared electronically, with the primary transaction information and new issue data on NowCM’s documentation platform.

A timeline for the launch of the workflow, which has been designed to connect institutional investors to electronic data, has not yet been revealed.

TS Imagine EMS integrates with Appital’s Bookbuilding platform

Equity Capital Marketplace, Appital’s, Bookbuilding platform will be integrated with TS Imagine’s multi-asset Execution Management System (EMS).

Trading, portfolio, and risk management solutions provider, TS Imagine, has chosen to integrate Appital’s Bookbuilding platform with its EMS to provide buy-side clients with greater access to liquidity.

Post the credit crunch, liquidity has become harder to source for both buyers and sellers, and TS Imagine intends to leverage Appital’s specialism in providing buy-side firms with exposure to deal flow opportunities, including in highly illiquid and mid-cap stocks, with real-time visibility.

The announcement follows the recent Appital collaboration with executing brokers Instinet and Bernstein and in anticipation of Appital’s launch later this year.

FTX partners with Eventus for trade surveillance on its markets

Eventus, a trade surveillance solutions provider, has been selected by FTX to monitor risk and crime on all of its markets globally.

Following announcements of a closer partnership between the two firms at the start of the FTX Crypto Bahamas Conference, FTX has contracted with Eventus to deploy the firm’s Validus platform for trade surveillance and risk monitoring.

The relationship between FTX and Eventus can be traced back to 2021, when FTX US chose to deploy the Validus offering on the FTX US spot market and on FTX US derivatives.

Eventus’ director of regulatory affairs, Mike Castiglione, spoke on the United States Crypto Regulation panel of the Crypto Bahamas Conference on April 28.

Fenergo completes acquisition of Sentinels

Fenergo, a digital solutions provider, known for developing Know Your Customer (KYC) and Client Lifestyle Management (CLM) oriented solutions, has completed its acquisition of Sentinels.

Sentinels, which was launched in 2019, is an anti-money laundering (AML) transaction monitoring new market entrant that runs on artificial intelligence (AI) based technology. The acquisition, which has been completed for an undisclosed amount, intends to strengthen Fenergo’s ability to deliver end-to-end Software-as-a-Service (SaaS) based-Client Lifecycle Management (CLM) and smart transaction monitoring to financial firms.

The deal follows the financial sector’s continued battle with financial crime and evolving regulatory obligations. In light of this, Fenergo aims to leverage Sentinels’ transaction monitoring solutions, which have been designed to detect and eliminate criminal transactions at scale, alongside continuing to push its own solutions that help users address KYC and AML regulations.

Both Fenergo and Sentinel’s solutions are available on the cloud.

TNS announces market data coverage for all US Equity Options groups

Financial services and telecommunications provider, Transaction Network Services (TNS), has announced that it can now enable firms to directly access market data from all United States Equity Option Exchanges. This is all to provide reduced complexity and significant cost savings.

This has been achieved through TNS’ mutualized exchange connections and status as a registered data vendor with all 16 Equity Option Exchanges in the US.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

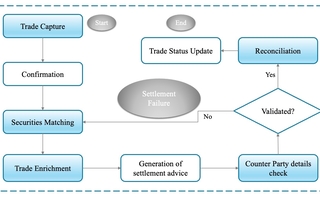

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.