This Week: EuroCTP, CME/DTCC, State Street, Broadridge and more

A summary of the latest financial technology news.

EuroCTP selects advisory board chair in bid to prove commitment to consolidated tape creation

EuroCTP, the company set up by 14 European exchanges in a bid to become the provider of the EU consolidated tape (CT) for equities, has announced its incorporation and the appointment of its supervisory board chair, Jorge Yzaguirre Scharfhausen, who is currently the chief executive officer at Bolsas y Mercados Españoles. Spokesperson Niels Tomm says EuroCTP is in the process of hiring a CEO, which it hopes to announce soon.

EuroCTP is the first equities CT initiative to incorporate as a company. Tomm hopes that the news of incorporation and selection of Scharfhausen will demonstrate the company’s commitment to making the European consolidated tape happen, a process that has been marked by fits, starts, and unanswered questions.

Adamantia, a group of financial institutions, is also competing to become the EU equities tape provider but has not yet incorporated. Bloomberg, MarketAxxess, and Tradeweb have already announced a joint venture to provide the EU tape for bonds.

Questions remain about the scope, type, and timeline of the eventual CT. Whether the CT for bonds or equities will launch first remains to be decided, Tomm says.

For EuroCTP, “details matter.” Tomm says decision-makers have yet to decide what type of tape will need to be built. “I think the political decision has been made. But that is only, in a way, the rough framework. Once the [technological] details become clear, it’s going to be easier to really build the tape as it is requested to be provided.”

Once that is decided, “We will build whatever tape the European commission or the European legislators are requesting to be built,” he says.

The company is in the request-for-proposal process for a technical provider and is hiring a CEO and CTO, whom EuroCTP hopes to announce soon. The supervisory board, who mostly work pro bono, represent the respective European exchanges and were chosen on the basis that they did not work within their exchanges’ data businesses.

Finding people who fit the profile was not difficult, says Tomm, but convincing them was a different matter. Tomm, for example, already wears multiple hats at Deutsche Boerse, China Europe International Exchange AG, and the Federation of European Securities Exchanges. But for many others on the board, the goal of creating a European CT happen was enough motivation in itself. “I think everyone understood that we needed to show really good commitment and that we have a business case.”

Tomm is optimistic that the announcement of board chair will demonstrate EuroCTP’s commitment to the project, which it began in late 2020 and announced in February. Tomm is aware that their commitment to CT is “sometimes questioned,” as some wonder if “this is, in a way, rather a lobby stunt.” But with the incorporation and the announcement of their governance structure, “I hope that we prove that we are seriously committed,” adding that EuroCTP have already invested a lot of money in the project. “That will remain the case,” he says.

EuroCTP does not engage in the legislative process but is watching it closely as it awaits further directives about what final structure that tape will adopt.

As for the eventual roll-out, “I don’t know whether it’s still going to happen in 2024,” Tomm says, referencing earlier timelines. Accounting for the time it will take to establish the tender process and finalize the technical provisions, “I would say earliest late ’24, early ’25.”

From there, it will depend on how long that process takes and who’s going to be the winner of the tender.

“So, of course, we hope that is going to be us. I mean that’s our main aim, but we’ll see,” Tomm says.

CME Group and DTCC receive regulatory go-ahead for treasury cross-margining arrangement

CME Group and The Depository Trust & Clearing Corporation (DTCC), a post-trade market infrastructure provider, have received approval from the Securities Exchange Commission and the Commodity Futures Trading Commission for an expanded cross-margining arrangement. This will enable capital efficiencies for clearing members trading and clearing both CME Group Interest Rate futures and US Treasury securities. Launch is expected in January 2024.

The arrangement permits eligible clearing members of CME and the DTCC’s Fixed Income Clearing Corporation (FICC)’s Government Securities Division (GSD) to cross-margin more products than previously allowed.

These include CME Group SOFR futures, Ultra 10-Year U.S. Treasury Note futures and Ultra U.S. Treasury Bond futures, and FICC-cleared U.S. Treasury notes and bonds. Repo transactions with Treasury collateral and a greater than one-year remaining time to maturity are also eligible under the new agreement.

FlexTrade expands Tradefeedr relationship

FlexTrade Systems, a provider of execution and order management systems, has integrated FX data analytics provider Tradefeedr’s FX pre-trade data within its FlexTRADER EMS platform.

Buy-side clients using FlexTrade will now have access to TradeFeedr’s FX pre-trade forecast data API.

The offering brings standardized, aggregated trading data into one platform, whether executed by algo or risk transfer (RFQ or RFS). With Tradefeedr’s data integrated into FlexTRADER EMS, users can also create automation workflows within FlexTrade’s AlgoWheel.

UOB Asset Management renews custody and fund administration mandate with State Street

State Street Corporation has been reappointed to provide custodian and fund administration to UOB Asset Management (UOBAM) in Asia region for ten more years.

The agreement renews the firms’ relationship, which began in 2017, when State Street was put in charge of global custody, fund accounting, transfer agency, trustee services, investment operations, financial reporting and collateral management for UOBAM’s Singapore arm. State Street has since taken on support of UOBAM’s Malaysia office and the release of UOBAM’s ETF in Taiwan.

The relationship is critical for State Street’s asset management business in Southeast Asia, according to the press release. As part of the relationship, State Street provides middle- and back-office functions, as well as technology and data with the State Street Alpha platform.

Broadridge releases reconciliation and matching solution, BRx Match

Broadridge Financial Solutions, a trading infrastructure provider, announced the launch of BRx Match, a cloud-based reconciliation and matching solution. The platform works to automate the reconciliation process to simplify data acquisition and matching engines for business users.

BRx Match performs reconciliations for securities, cash, derivatives, reference data, card services, financial, and insurance data. The platform offers exception management, workflow, Consolidated Audit Trail, and holistic reporting capabilities.

Broadridge clients will receive the BRx Match UI and can opt in to receive the self-service capability.

Axioma and Jacobi partner on risk analytics and workflow tools

Axioma, a provider of factor risk models, portfolio construction tools, and enterprise risk solutions, has partnered with Jacobi, a white-label technology provider for designing and managing portfolios and investment workflows.

The partnership targets asset managers, wealth managers, consultants and asset owners, who will now have access to Axioma’s equity and multi-asset class factor risk models and portfolio optimizer tools through Jacobi.

Platform users will have access to historical datasets, as well as forward-looking analysis for different scenarios and stress events.

SIX launches automated corporate action calendar

SIX, a financial information provider, has released an automated corporate action calendar. The calendar tracks and processes upcoming corporate actions, including mergers and acquisitions, dividends, and stock buybacks.

The calendar is apart of SIX iD, SIX’s data display tool, and uses a client’s investment portfolio to automate alerts for relevant changes.

Eventus gives facelift to Validus platform

Eventus, a provider of trade surveillance software, has introduced a new user interface for its Validus platform. The UI offers compliance management across asset classes, with a dashboard layer, investigation tools for surveillance insights and data visualization tools.

The tool allows compliance and surveillance staff to visualize data in order to respond to alerts triggered by the automated system. Validus gives users surveillance in equities, options, futures, foreign exchange, fixed income and digital assets.

TS Imagine partners with Eflow for regulatory compliance capabilities

TS Imagine, a provider of trading, portfolio, and risk management solutions, has partnered with Eflow, a provider of regulatory compliance solutions for the financial industry.

The partnership will bolster TS Imagine’s regulatory compliance offerings for clients. Trade surveillance capabilities will now be available within TS Imagine’s execution, order, and portfolio management solutions.

TS Imagine’s TradeSmart OEMS product will integrate with Eflow’s solutions across all asset classes.

Causality Link adds generative AI to its research platform

Causality Link, a financial information technology provider, has introduced generative AI into its AI-driven research platform. Causality Link uses generative AI to present readable pictures of industry news articles and press in order to generate predications about economic performance.

The company is set to offer a free trial. Users can select public companies to track, and Causality Link will deliver daily personalized updates on relevant news published in the last 24 hours.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

This Week: Delta Capita/SSimple, BNY Mellon, DTCC, Broadridge, and more

A summary of the latest financial technology news.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

LSEG-Microsoft products on track for 2024 release

The exchange’s to-do list includes embedding its data, analytics, and workflows in the Microsoft Teams and productivity suite.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

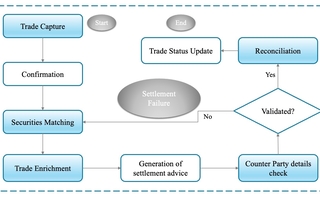

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.