More trading venues face extra supervision under FCA plan

“Woolly” rules fuel concern that bulletin boards and tech providers could be swept in

A new consultation paper from the Financial Conduct Authority sets the scene for regulators to bring more trading venues under close scrutiny, according to lawyers, which could be perceived as diverging from the UK government’s post-Brexit aim of making the jurisdiction easier to navigate for financial market participants.

“The big question coming out of the consultation is whether the proposed changes are strictly clarificatory or whether the FCA is actually seeking to move the dial on which trading activities need be carried on under the badge of a regulated trading venue,” says Antony Hainsworth, partner at law firm DLA Piper.

Published on September 22, ‘CP22/18: Guidance on the trading venue perimeter’, is part of the Wholesale Markets Review. The paper says changing definitions of multilateral systems and technology have made it challenging to distinguish between “unregulated communication arrangements, authorized firms that arrange deals in investments, and trading venues”. That could be detrimental to investor protection and market integrity and may put venues subject to no or less stringent regulatory requirements at a competitive advantage to authorized peers, says the regulator.

The proposed changes are almost all in the Perimeter Guidance Manual, which suggests they are intended to be clarificatory.

But the FCA is also concerned that some firms operate arrangements that constitute multilateral systems without being authorized. This, says Hainsworth, “suggests the regulator is seeking to tighten its approach to business models which are on the margins. Different banks, interdealer brokers, technology startups and some asset managers all potentially have skin-in-the-game here.”

The FCA’s assessment of trading systems will take into account factors including target users and whether the remuneration of the operator is linked to the interaction of trading interests. It has previously discouraged brokerage charging models—where price aggregators charge a commission fee to dealers whose trades they facilitate—as part of a clampdown on payment for order flow. Buy-side firms, meanwhile, have joined dealers in pushing back on the use of brokerage charging by some liquidity aggregators.

The proposed guidance generally lets internal crossing by portfolio managers off the hook, because this typically wouldn’t meet the definition of a multilateral trading system. Nor would the practice of investment firms arranging a transaction between two clients off-venue, and then executing it on a regulated venue. Portfolio compression services are also exempted.

Crowdfunding platforms would be exempt unless they allow multiple third-party buying and selling trading interests to interact. Bulletin boards that only pool and advertise indications of interest, bids and offers should also be exempt in most cases, but again, there are exceptions.

The FCA paper says that while a bulletin board is not a multilateral system in cases where the trading interests cannot interact within it, that could change if, for example, the board allows users to negotiate the essential terms of a transaction.

The FCA also says: “Voice broking may, but need not, comprise the operation of a multilateral system.” For example, a firm that operates a platform where trading interests of clients are broadcast to other users and then engages in voice broking to enable negotiation between these parties might operate a trading system.

Who’s on the hook?

Nathaniel Lalone, partner at Katten Muchin Rosenman, says the tone of the document suggests that the FCA believes there are a number of service providers that should be authorized as trading venues but are not at present.

He adds: “If the effect of the consultation is to sweep a number of currently unauthorized firms into the scope of FCA supervision, that would not exactly be consistent with the new government’s deregulatory philosophy.”

Describing the post-Mifid II trading venue perimeter as “notoriously tricky to navigate”, Lalone says “it’s not clear that more vaguely worded guidance from a regulator is going to make things any easier. If the FCA wants to establish greater regulatory certainty, it should provide concrete statements rather than woolly language that is susceptible to widely differing interpretations.”

A third lawyer says the consultation largely follows one from the European Securities and Markets Authority, “especially in wanting to bring in more negotiation platforms, etc, into the definition of a multilateral system, which is unfortunate.”

Unsurprisingly, existing regulated trading venues are more likely to welcome a tighter regime. The head of regulation at one such venue says that without the intervention of the FCA and Esma, the marketplace risks descending into an “unlevel playing field”.

“Any systems that perhaps are enhanced versions of what we currently see in the market as providing electronic pathways between two trading counterparties, and those electronic pathways being enhanced, being able to trade not just with one another on a bilateral basis, but also with other third-party buying and selling interests, I think this is probably what the FCA is trying to target,” says the trading venue regulation head.

He accepts that the language is “woolly” and “could have been a bit clearer”, but adds that this is “probably on purpose, because it seems a fact-gathering exercise” so the FCA will want to cover as many entities as possible.

Talking tech

Where technology providers are concerned, the regulator draws a distinction between multilateral systems that may require supervision and general purpose communications systems that do not. But if a general communications system is part of a facility that is operated for the purpose of arranging transactions in financial instruments, the FCA would consider that system a trading venue if other elements of the definition of a multilateral system are met. The FCA also says it is possible that a firm operates more than one piece of technology, which when taken together have the characteristics of a trading system or facility.

A software consultant says the new UK rules “may force some large exchanges to differentiate more between technology and other services they provide that may not benefit from a regulatory stamp of approval by inference.”

The FCA says that if two counterparties negotiate within a system, it does not mean the system is bilateral. It would still be considered multilateral if it comprises multiple third-party buying and selling trading interests. Instead, what matters is whether the system, at the point of entry, is designed to enable one person to interact with others. In the FCA’s view, the definition of interaction in a multilateral system takes the form of an exchange of information relevant to the essential terms of a transaction, such as price and quantity, but does not require execution and settlement. Trading interests include orders, quotes and indications of interest.

However, Benjamin Maconick, managing associate in Linklaters’ financial regulation team, thinks it unlikely that lots more firms would require authorization as a trading venue as a result of the guidance.

That stands in contrast to the recent Esma consultation paper, he says, which takes a “much more expansive view of what constitutes a multilateral system,” including the use of execution management systems.

In 2019, Europe’s markets regulator began investigating claims that some middleware firms are de facto trading platforms, without being subject to platform regulations. Esma declined to comment for this story.

Sylvain Thieullent, chief executive of Horizon Software, sees “great value” in the UK diverging from the EU in terms of taxes and fees, to make the post-Brexit UK more attractive. But since banks have already moved some activities to the EU, any regulatory divergence will imply “significant costs of adaptation at different levels for them.”

Michael Ruck, a partner at K&L Gates and former enforcement lawyer at the FCA, agrees that any divergence between the UK market and the wider EU regime will “almost inevitably lead to an increase in costs and the need to ensure compliance with a new approach.” But he adds: “It appears unlikely to immediately result in a significant increase.”

The FCA seeks views on its proposals by November 11, 2022 and intends to publish a policy statement in Q2 2023.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

For MarketAxess, portfolio trading buoys flat revenue in Q3

The vendor is betting on new platforms like X-Pro and Adaptive Auto-X, which helped forge a record quarter for platform usage.

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

Nasdaq says SaaS business now makes up 37% of revenues

The exchange operator’s Q3 earnings bring the Adenza and Verafin acquisitions center stage.

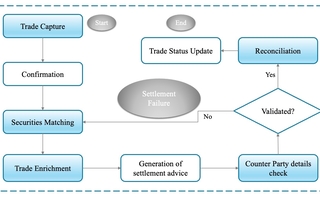

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

BlackRock forecasts return to fixed income amid efforts to electronify market

The world's largest asset manager expects bond markets to make headway once rates settle.