Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

The rumors that Trading Technologies (TT) was set to be acquired began last year, and the reports pegged Goldman Sachs as the leading candidate to buy the futures trading platform provider—and then those talks fell apart.

Even with that setback, the vendor, which is partly owned by Chicago-based investment firm The FSB Companies, is still very much on the block to be sold—and sources have indicated that a sale will likely happen soon, though the buyer’s identity so far remains a mystery. This puts TT in a slightly awkward position; the company can’t make any big, flashy investments, and some of its more ambitious projects have been put on hold to ensure that these investments align with the new owner’s roadmap.

Take, for example, the rollout of its new order management system (OMS), which went live last fall. Farley Owens, TT’s recently appointed president, views this offering as being “probably our biggest area of growth potential,” but some clients are on the sidelines, waiting to see who the eventual owner will be.

“Some of our customers are waiting to see what happens with the sale of TT,” Owens says. “They want to know who’s going to own TT before they make a commitment to spend more money and do more integration—if it’s somebody they don’t like, they don’t want to do that.”

But even as some existing customers wait, TT has won over a handful of converts.

“We’ve actually signed three deals that have yet to be announced across three different types of customers,” he says. “One of them is a global brokerage firm that does execution for buy-side firms; we signed a deal with a pretty sizable regional bank; and then we also signed a deal with a commercial energy firm. So that’s three different types of firms utilizing our OMS in different ways.”

The OMS came about thanks to a decision made several years ago to sunset the vendor’s flagship X_Trader execution management system (EMS)—a monolithic, mostly closed-off system that was designed in the mid-1990s using a client-server architecture that was initially made available only for on-premise deployment.

Today, Trading Technologies has migrated almost all of its users from X_Trader to the new TT trading platform. “We literally have one customer with one desk accessing one market,” says Owens, who has been with the company for almost 20 years and took over as president in February. “It’s one of our largest bank customers that still has access to Euronext while they work out their back-end integration for wholesale trades. So it’s one or two users that will still be on the platform for another couple of weeks. Everybody else is on the TT platform.”

Echoes of the past

The futures trading platform space is a competitive one that has seen a lot of consolidation. Ion Group has become a powerhouse there, like it also has in fixed income—especially after it acquired Fidessa, though that integration hasn’t been without its issues. Broadridge has also grown its futures trading presence with the addition of Itiviti, and well before that deal there was FIS–SunGard. Mainly in Asia, CQG competes with TT, and for options, there’s Vela Trading Systems, which recently merged with Exegy.

In this competitive environment that features some larger contenders, under the leadership of Rick Lane—the former CEO of Trading Technologies who left earlier this year to join Citadel as the CTO of core engineering—the company burnished a reputation as being at the leading edge of innovation in futures.

“They have always been innovative and when you look at the broader space, a lot of their competitors have been acquired,” says Brad Bailey, research director with consultancy Celent’s capital markets division. “The futures industry is an important industry and the products in the space are key for so many different people, and not just financial firms—it’s the hedgers and the farmers, too.”

While almost every vendor is now ditching legacy platforms in favor of cloud-based offerings, TT made that decision earlier than others. In addition to the development of an OMS, the company was also early in developing institutional-grade tools for crypto trading; it launched an infrastructure-as-a-service offering; it started plotting a move away from screens in 2018; and the year before that, it made a major investment in Neurensic to improve its machine-learning capabilities.

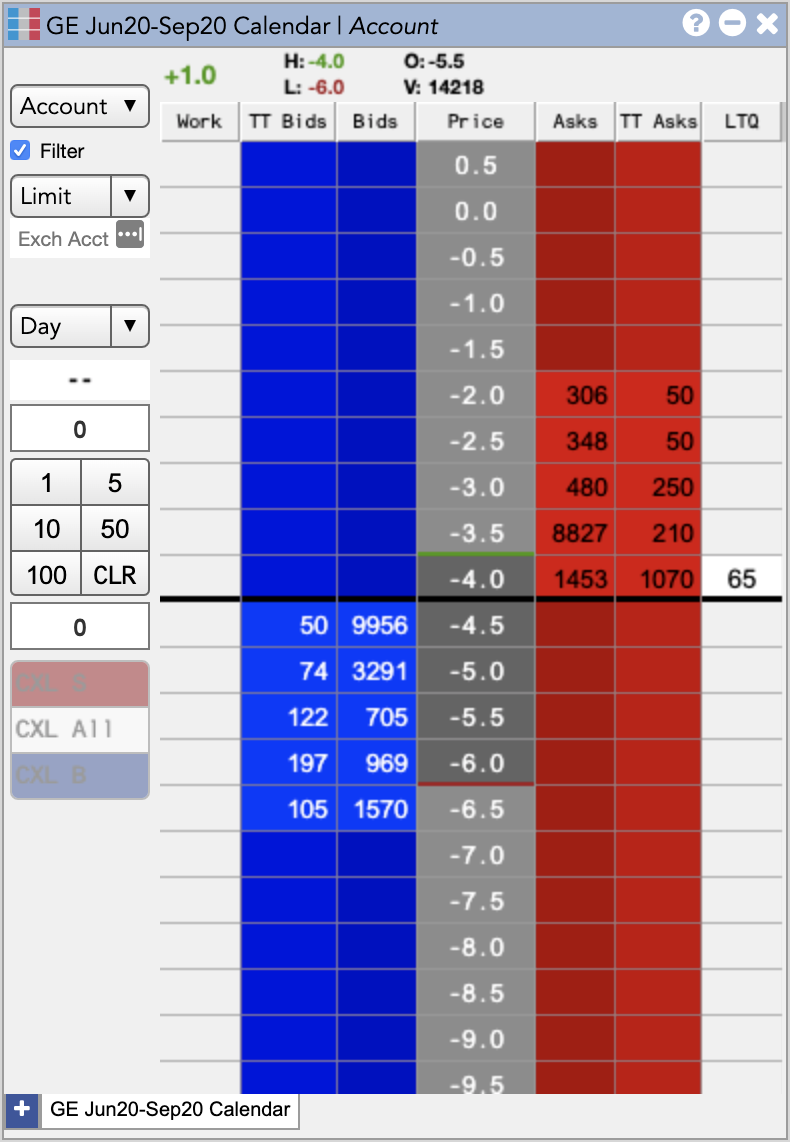

Perhaps most ambitious, though, was a project to help firms reduce their market data costs in futures trading. The platform, dubbed Echo Chamber, was designed to combine futures contracts traded on different exchanges to provide a single view of each, no matter where the contract is traded. (See below for a look at Echo Chamber’s UI.)

Lane said back in May 2020: “We are not aggregating lookalike or similar market data feeds into one—that’s a practice we’ve done for many, many years. What we’re doing here is taking all of the order flow that TT platform clients are trading, and before that order gets to the exchange, we are essentially echoing that order back as a book update. So we are creating a TT-only view into these publicly traded, exchange-listed derivatives that solves a couple of problems.”

As is true of any inspired idea, the project needed significant buy-in from large trading participants in order for it to achieve its full potential as something of an industry utility that helps firms to cut their market data costs, rather than simply being an internal risk application. But because of the uncertainty created by the coming sale of TT, Echo Chamber has been put on hold, Owens says.

“As we were going through the sale process last year, the leading contender to buy us actually told us that they’d prefer if we did not work on that, and so we kind of put it on the shelf. It’s there, and we still have some customers expressing interest to use that internally for their own trading within their own firm—like a large prop shop. And then there’s the broader version of that, which is a more global feed that we would publish out,” Owens says.

“But we’re still taking the same approach: Since the sale process really never stopped—as we’re going through this—we don’t want to spend a lot of time and energy on something that never sees the light of day because the person that wants to buy us is just not interested in it. So we’ve put those resources on things that we know people want,” Owens says.

Owens says, however, that internally TT still believes in the platform, that “it’s a viable product that people would be willing to pay for,” and that it’s something the vendor will “probably revisit as soon as this sales process is over.”

Waiting…

Celent’s Bailey says that it makes sense that there’s interest out there in acquiring Trading Technologies, and that interest has to do with both historical trends and where there are still needs in the market.

“Futures trading has been electronic for quite a long time—and even options on futures are getting more electronic—so it’s a competitive space, which makes TT interesting,” he says. “Additionally, equity algos have grown much faster there than in futures. So even though you have systematic and automated futures trading, CTAs and CPOs and all those traders still might not be getting all they can from execution algos in futures.”

Owens notes that while TT has had to ease off the accelerator on some projects, it’s not as if its developers and engineers are standing around. In fact, he says that now that the migration from X_Trader to the TT platform is essentially complete, there’s a long list of projects that need to be addressed.

“At this point, having just completed the migration, we have a long pipeline of things to do, whether that’s outstanding customer requests, or new markets, or some of the OMS functionality that we have yet to deliver—we really have more work than resources at the moment,” he says. “Right now we have some priorities that we have to get done because we’ve got business to win right now and the sale of the company will happen way before that all clears up.”

And the instant there is clarity around the future of the company—because TT has invested in cloud and has opened the platform up to include support for an array of other markets and asset classes beyond futures and options—Owens says they will be able to adjust quickly.

“We think the new platform is flexible enough with the newer technology that we can shift gears and move quickly whether to support a new market, or integrate with other vendors in ways that provide unique solutions whether in data analytics or other things,” he says. “So it will be a little bit of a wait-and-see, because depending on who does buy us, they will have their own things that they may want to integrate with us to provide solutions to their customers.”

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

This Week: JP Morgan, Broadridge, Lloyds, JSE, Schroders, and more

A summary of the latest financial technology news.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: Market data spend and nice-to-have vs. need-to-have decisions

Cost is not the top factor driving the decision to switch data providers. Anthony looks at what’s behind the evolution of spending priorities.

The consolidated tapes are taking shape—but what shape exactly?

With political appetite established on both sides of the Channel, attention is turning to the technical details.