Charles River, software, data sales drive State Street in Q2

As traditional revenue lines declined at the custodian as a result of market forces, front-office software sales made big gains in its quarterly results.

Five years on, State Street’s $2.6 billion acquisition of Charles River Development is paying dividends. The custodian’s front-office software and data business brought in revenues of $162 million for Q2—an increase of 29% over the same period last year, and a 49% increase over Q1 this year.

In the bank’s Q2 earnings call, held Friday, chief financial officer Eric Aboaf said State Street’s overall 5.3% revenue increase year-on-year was “driven by our front-office solutions business … [which] enabled us to offset headwinds in other areas,” where overall fee growth was less than the firm had hoped to deliver, such as lower asset servicing fees as a result of less custodial business.

The front-office software and data business line—though a small part of State Street’s overall $3.1 billion revenues for Q2—was a standout performer while many other business lines, including back-office servicing, management fees, and foreign exchange trading, declined year-on-year as a result of lower client activity over the year, though most rallied over Q1 as markets rose and as a result of net new business.

The move to diversify revenues has been evident in major acquisitions of software and vendors, largely by exchanges—for example, Intercontinental Exchange’s acquisition of Interactive Data in 2015, and the London Stock Exchange Group’s acquisition of Refinitiv—with activity by custodians more modest and tactical. For example, Northern Trust bought Parilux Investment Technology to strengthen its Front-Office Solutions business, while BNY Mellon has owned Eagle Investment Systems since 2001.

State Street CEO Ron O’Hanley said on the call that the performance underscores the importance of Alpha, the firm’s front-to-back-office investment and data management platform—of which the Charles River software forms an integral part—to its long-term growth.

“The Charles River wealth management solution continues to resonate with clients and drove a number of on-premise installs this quarter,” O’Hanley said, adding that the firm also converted long-term clients from on-premise deployments to SaaS (Software-as-a-Service) models during Q2.

Aboaf added that 60% of State Street’s software clients now use its SaaS platform, with wealth management clients accounting for two-thirds of the uptick during Q2.

“We continue to advance and broaden our outsourced solutions capabilities across the front, middle and back office,” he said, citing the recent addition of ETF functionality, and noting a strong overall pipeline for the business.

However, the division’s strong performance in Q2 could make Q3 look less impressive, Aboaf warned: He expects overall fee revenues to be down between 1% and 1.5% in Q3, and expects front-office software and data revenues to drop 7% in Q3. “We don’t expect a level of on-premise renewals in 3Q that we saw this quarter,” he said.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

For MarketAxess, portfolio trading buoys flat revenue in Q3

The vendor is betting on new platforms like X-Pro and Adaptive Auto-X, which helped forge a record quarter for platform usage.

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

Nasdaq says SaaS business now makes up 37% of revenues

The exchange operator’s Q3 earnings bring the Adenza and Verafin acquisitions center stage.

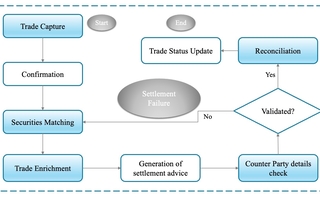

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

BlackRock forecasts return to fixed income amid efforts to electronify market

The world's largest asset manager expects bond markets to make headway once rates settle.