Bloomberg rolls out integrated alt data for Terminal users

The initial launch includes consumer spend and foot traffic geolocation data—pre-integrated with all the other data on the Bloomberg Terminal.

Bloomberg has made alternative data on consumer spending from its 2020 acquisition of alternative data provider Second Measure and geolocation data from Placer.ai available in its Bloomberg Professional Terminal. The aim is to give Terminal users early insights into company performance based on alternative data as an integrated part of their research workflows.

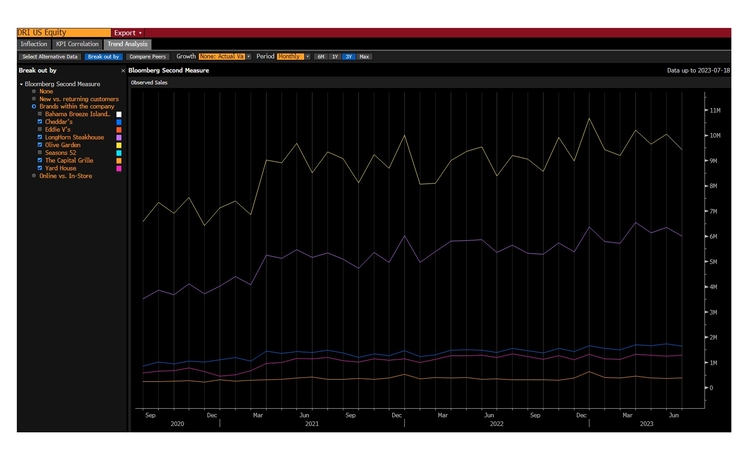

Available by typing ALTD <GO> on a Bloomberg Terminal, or as an integrated element within a user’s Launchpad screen, the initial data includes credit and debit card transaction data and analytics from Bloomberg Second Measure, covering more than 20 million cardholders, as well as geolocation data generated by retail consumers’ mobile devices. It also offers metrics such as observed sales, observed transactions, observed customers, average transaction value, transactions per customer, sales per customer, and estimated number of visits, as well as whether sales are from online purchases or in-store sales.

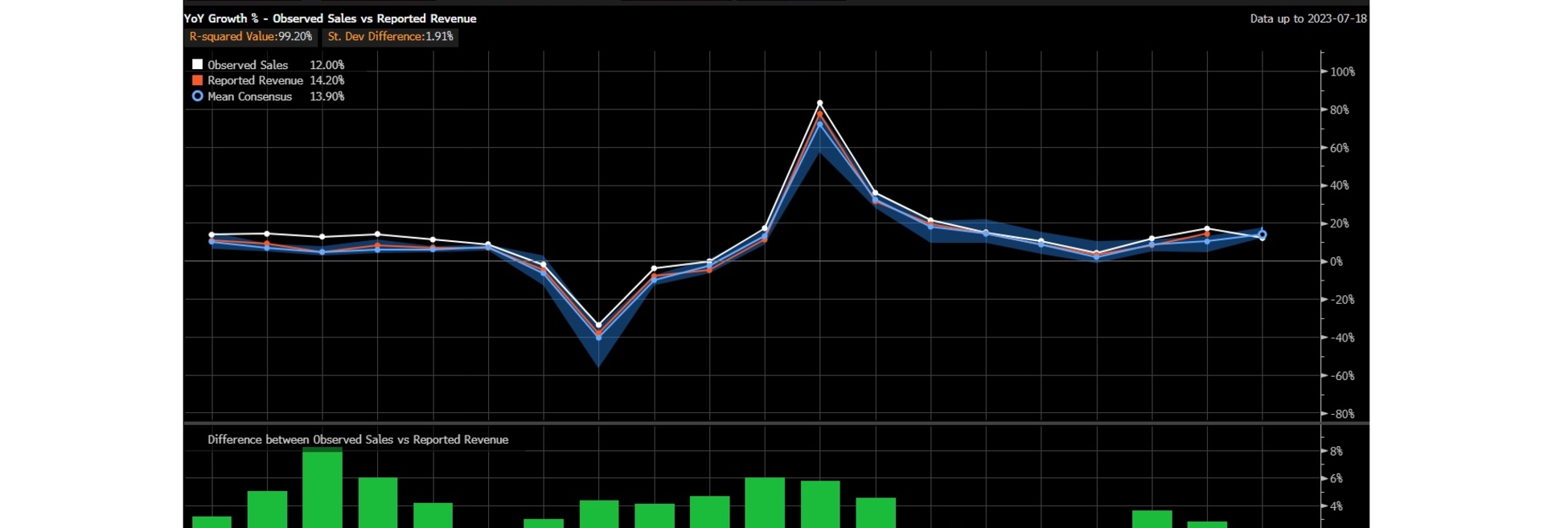

Clients can use the data to compare assumed revenues from observed sales against reported revenues, and to compare how different companies perform across these metrics. They will also soon be able to use a new function called Quarter-to-Date that shows how each of these metrics are progressing during a company’s fiscal quarter against industry estimates, by tying together the Second Measure and Placer.ai data with estimates and other information already in the Bloomberg Terminal.

The data can be plotted and presented in a variety of charts and analytics, and is designed to enable users—primarily research analysts and portfolio managers, initially—to identify relationships and discrepancies between the reported data and alternative data, which may alert them to trends they haven’t spotted and prompt further research and investigation. That’s where tools like Bloomberg’s BQuant cloud-based testing and analytics platform come in: the alternative data will in due course be added to BQuant, allowing users to interrogate the data by leveraging greater compute power, says Richard Lai, global head of alternative data in the office of the CTO at Bloomberg.

David Easthope, head of fintech, market structure and technology at research firm Coalition Greenwich, says the move is a natural progression for the vendor to incorporate alternative data into the Terminal because it can now be more easily integrated into users’ strategies as alt data becomes more widely accepted as another dataset to drive research.

“I was an investment analyst before I became an industry analyst, and I can tell you that having these datasets on consumer data and foot traffic is a big deal,” Easthope says. “This will make these datasets interoperable with traditional datasets, such as research, news, and everything else, all in one place.”

“We wanted to bring this to people who haven’t had access to alternative data in the past,” Lai says. “For example, sell-side equity research professionals typically haven’t had access to this in the past, and have been at a disadvantage to their buy-side clients. We want to make this data table stakes.”

For example, whereas large hedge funds have employed data science teams to generate alpha, the heavy lifting required to make alternative data interoperable with other datasets remains a key challenge for much of the industry.

“Now that these strategies are getting more mature, firms are looking for more datasets to expand their universe,” Easthope says. “The key thing here is making it work with the data they already have. That’s one of the key pain points for firms. The majority of the market still needs help integrating this data. Not every firm has huge data science teams and lots of Python developers.”

Key to integrating the data comprehensively and quickly is Bloomberg’s Unified Data Model, which allows the vendor to tie all its data together, including prices, fundamental data, and estimates to alternative data—not just at a ticker level, but across an organization’s entire corporate structure, allowing users to account for the impact of this data on individual business areas and the parent organization as a whole.

“We’ve been working on UDM for a long time. That’s how we can tie all the data together,” Lai says.

By performing the heavy lifting of integrating and mapping the datasets so firms don’t need to, “you don’t need a data science team to engage with alternative data,” Lai says. This drastically opens up the potential user base for the data. “The second group I’m excited about is traditional long-only investment managers. They’ve been slower to the alt data game, and now we’re seeing a lot of engagement from them—and I think that’s a larger market than hedge funds.”

When it acquired Second Measure in December 2020, Bloomberg knew it wanted to transform the way people research companies by integrating alternative data into the Terminal, says Lai, who joined Bloomberg around the same time as the acquisition and spent a lot of time talking to clients while the company decided how best to bring the data to clients.

By the middle of 2022, Bloomberg had figured out what it wanted to achieve with the data, and by March of this year, began a beta testing program, approaching customers and asking them to opt in. The beta program was oversubscribed by multiples of what the vendor expected, Lai says.

The beta testing program wrapped up at the end of July, and since then the ALTD <GO> function has been in soft launch, where any Terminal user can access it ahead of the official launch on September 7.

Lai says the company expected—and received—an excited response from equity analysts, portfolio managers, sell-side firms and hedge funds, but was surprised to also see interest in the alternative data from macro investors looking to identify macro trends and consumer discretionary spending trends, as well as from fixed-income professionals. While bonds trade differently from equities, much of the research workflow in fixed income mirrors that for equities when looking at the same issuer, Lai says. As a result, the vendor is exploring other potential use cases for the data in the Terminal.

Bloomberg is also exploring what other alternative data sources to add to the service in the future, and how else to make the data available.

“Our vision is to bring on more datasets. We’re working a lot with clients to understand what datasets we should add after this, and which offer the most value,” Lai says, adding that future datasets will probably comprise a mix of proprietary Bloomberg data, as well as third-party content. “There are a lot of people doing a good job in this space, who have good data assets, and who we’d be keen to partner with.”

Bloomberg will continue to distribute the Second Measure data via a datafeed, but over the coming months will also provide it via different distribution mechanisms and delivery options. For example, the alternative data will soon be available as part of Bloomberg’s Data License service, and whereas it’s currently provided as a batch file, Lai says the vendor may consider selling the data on a per-security basis in the future.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

The IMD Wrap: Talkin’ ’bout my generation

As a Gen-Xer, Max tells GenAI to get off his lawn—after it's mowed it, watered it and trimmed the shrubs so he can sit back and enjoy it.

Waters Wavelength Podcast: The issue with corporate actions

Yogita Mehta from SIX joins to discuss the biggest challenges firms face when dealing with corporate actions.

Data catalog competition heats up as spending cools

Data catalogs represent a big step toward a shopping experience in the style of Amazon.com or iTunes for market data management and procurement. Here, we take a look at the key players in this space, old and new.

This Week: JP Morgan, Broadridge, Lloyds, JSE, Schroders, and more

A summary of the latest financial technology news.

What firms should know ahead of the DSB’s UPI launch

Six jurisdictions have set deadlines for firms to implement the derivatives identifier, with more expected to follow.

Has cloud cracked the multicast ‘holy grail’ for exchanges?

An examination of how exchanges—already migrating to the cloud—are working to solve the problem of multicasting in a new environment.

Waters Wrap: Market data spend and nice-to-have vs. need-to-have decisions

Cost is not the top factor driving the decision to switch data providers. Anthony looks at what’s behind the evolution of spending priorities.

The consolidated tapes are taking shape—but what shape exactly?

With political appetite established on both sides of the Channel, attention is turning to the technical details.