Major improvements have been made to the securities services operating model over the past decade, but inefficiencies in trade settlement processes remain, leading to thinning margins and longer settlement cycles. Key to addressing these challenges is the adoption of the unique transaction identifier (UTI), which would allow all parties to a trade to track securities transactions from end to end throughout their lifecycles

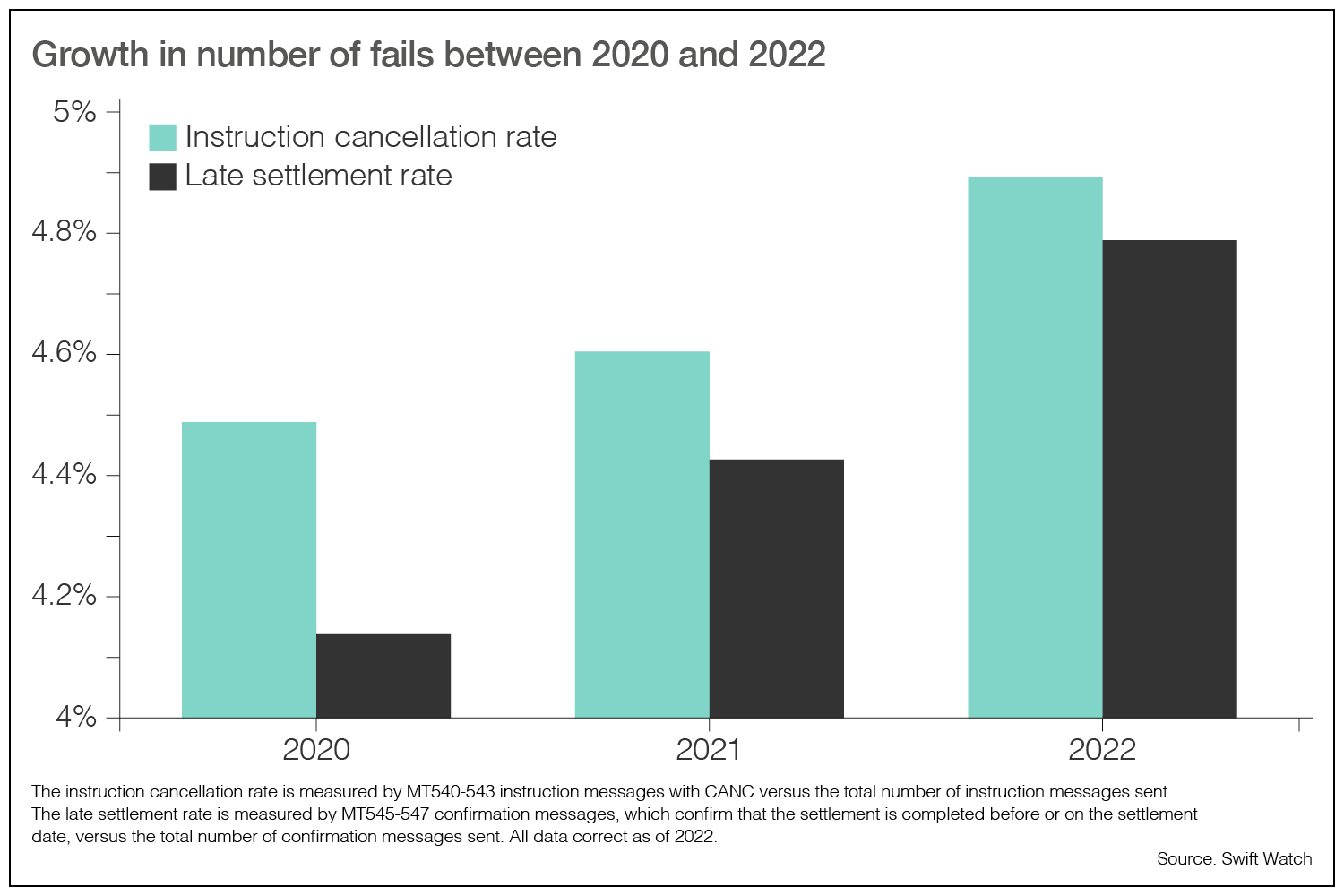

Swift business intelligence has shown that 5% of securities transactions sent for settlement do not complete on their expected settlement date. While this figure might seem low, it comes with associated risks, and translates to billions in operational costs and fees for the industry. The overall picture shows the number of fails growing too, as presented below.

Why trades fail

“The rate of settlement fails goes up when there are unstable market conditions, as we’ve experienced in the past few years,” explains Charifa El Otmani, director of capital markets strategy at Swift. “With a significant hike in transaction volumes, it inevitably follows that settlement fails will rise in tandem. However, market events and heightened geopolitical tensions are not the only factors driving up the volume of settlement fails. They’re also a result of long-standing challenges facing the securities industry that we’re working to overcome.”

Cross-border transactions are especially prone to failure, according to El Otmani. “This is because international transactions have longer intermediary chains, multiple regulatory jurisdictions, and rely on various messaging formats, data standards and technology platforms,” she says. “Even so, this is not an acceptable excuse for poor settlement discipline.”

Human error is another major contributor to settlement fails. With many smaller financial institutions still heavily reliant on manual systems, individuals in operations may key in the wrong data, for example, in a standing settlement instruction.

No time for complacency

Settlement failures also open market participants to multiple risks, which can be serious. For instance, an investment manager may miss a trading opportunity, contributing to a decline in client returns. Alternatively, when securities are not delivered, it can exacerbate credit risk. Regular settlement fails can also have an adverse impact on overall client experiences, potentially leading to reputational damage.

Settlement fails can also lead to additional costs. “For example, under the Settlement Discipline Regime, daily cash penalties are being enforced for trades that fail to settle on time in European Union-based central securities depositories,” El Otmani explains. “And mandatory buy-ins for counterparties remains a real prospect from 2025.”

T+1 settlement

The global trend towards T+1 settlement is likely to further incentivize market participants to optimize their processes. India is now live with T+1 for equities, while the US and Canada have confirmed adoption of T+1 in 2024. The UK has launched a task force to examine the case for shorter settlements. And the EU―despite some initial skepticism about adopting shorter settlement cycles―is also evaluating the merits of moving to T+1.

“Shorter settlement cycles compress the time available for counterparties to settle their trades,” El Otmani explains. “With less time to settle, if we don’t act as an industry, settlement fails are expected to increase, and so will the penalties. Given this trajectory, the current settlement fail rate for post-trade settlement is clearly not sustainable … and even less so if mandatory buy-ins are imposed,” she says.

Transparency is key

Currently, there is no way of uniquely identifying and tracking a transaction across all the intermediaries in the securities lifestyle. However, lowering settlement fails can be achieved if market participants make a few relatively simple changes to their business operations.

The most obvious would be if the wider industry were to adopt the UTI. This is an International Organization for Standardization (ISO) messaging standard that is a key enabler to track transactions end to end throughout the lifecycle of a trade and across the two sides of the transaction, allowing for easier and more seamless investigation and exception handling.

“The UTI enables counterparties to gain better transparency into the trading settlement lifecycle, helping them identify trades at risk of failing and take action to fix them before the settlement date,” says El Otmani.

The journey to having a UTI has started with ISO 23897:2020, which is already used for reporting over-the-counter derivatives and securities financing trades. Financial firms and industry bodies, together with Swift, are rolling out the UTI to other types of securities transactions as well. “We estimate that the UTI could help to halve the number of pre-settlement exceptions requiring investigation with a counterparty and reduce the number of matching or timing fails by 90%,” El Otmani confirms.

What firms can do

The advantages of the UTI can only be realised if financial institutions collaborate. “If transformation is to happen and the industry is to mitigate settlement fails, then the securities industry will need to work together,” says El Otmani. “Firms have a choice as to whether they invest in their operations in an isolated or siloed way or engage with their peers to tackle the root causes of settlement fails. If more institutions embrace the UTI, the industry-wide benefits will ultimately be significant.”

Sponsored

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com