Smashing barriers: How shortwave frequencies are making trading firms faster

Improvements in shortwave radio frequencies could be a leap forward in the latency race. But given the costs and technical challenges, is it worth the investment?

The race to zero has never been fiercer. Every millisecond is precious, especially at a time when volatility and trading volumes have surged, fueled by the Covid-19 pandemic, the rise of meme stocks, and ongoing geopolitical events. There are plenty of opportunities for firms seeking arbitrage gains.

Typically, high frequency trading (HFT) firms have used a combination of fiber and microwave connectivity, as well as hardware such as field-programmable gate arrays (FPGAs) to receive and process market data or send trade order messages with ultra low latency.

But the attention on relatively old technology is picking up speed. Experiments using shortwave radio frequencies, otherwise known as high-frequency broadcasting (HF), which use the 3 to 30 megahertz (MHz) frequency band started in the early 1900s, leading to Guglielmo Marconi’s first transatlantic radio signal broadcast in 1901. Since then, it has been used for a variety of use cases, including international broadcasting; military communications; air traffic control; and amateur radio, otherwise known as Ham radio.

But that is changing as trading firms and some low-latency providers see an opportunity to enter the race to zero. But the use of HF is not without some speed bumps, such as bandwidth (and hence throughput) limitations, as well as availability and reliability, atmospheric conditions, and lack of regulatory clarity.

Still, the use of shortwave technology for trading can already be seen, as Stefan Schlamp, head of quantitative analytics at Deutsche Börse, wrote in a LinkedIn post. Using Deutsche Börse’s A7 Analytics Platform, there is tangible data to distinguish shortwave trading based on reaction times in trades on the CME and Eurex.

In the post, Schlamp said the lowest “classical”—a combination of microwave and dedicated transatlantic fiber—latency is approximately 37 milliseconds. But the data from A7 shows the shift toward shortwave radio by HFT participants, providing a 9-millisecond latency advantage.

For context, the blink of an eye is, on average, 100 to 400 milliseconds.

“For trading the Euro Stoxx 50 future (FESX) and the Dax future (FDax) based on the S&P 500 E-mini (ES), this technology is now more important than the ‘classical’ route. For the 10-year T-Note future (ZN)/Euro-Bund future (FGBL) pair, HF does not (yet) dominate to the same degree,” Schlamp wrote in the post.

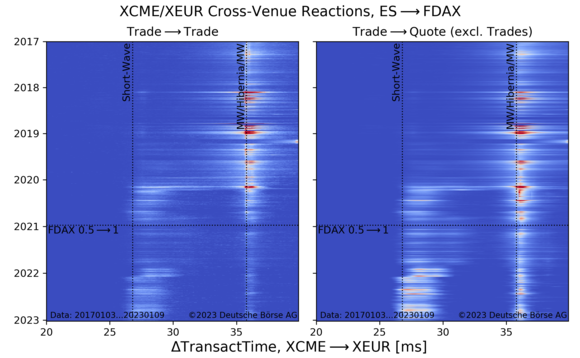

Separately, Shlamp sent WatersTechnology the diagram below showing the number of reactions (blue is fewer; red is many) for the FDax on Eurex to trades on the ES future on CME vs. the latency (horizontal axis) and over time (vertical axis).

These were also based on underlying data for both Eurex and CME available on the A7 platform.

The chart on the left only considers trades of the FDax, while the right only considers book updates, excluding those caused by trades.

The dotted vertical lines denote the expected latencies for a shortwave link and a “traditional” link—that is, microwave from Chicago to New York, then a fast transatlantic cable, then microwave from England to Frankfurt—respectively. The dotted horizontal line indicates a change of the tick size of the FDax from 0.5 to 1 index point.

Schlamp notes that there are isolated patches of shortwave reactions from early 2018. But since 2020, shortwave has replaced the traditional link for aggressively trading the FDax based on ES signals.

“The shortwave signatures appear less significant than they actually are. This is because the shortwave latency peaks are much wider and so the reaction counts are ‘spread out’ more. We also see that shortwave links are heavily used for passive orders (be it inserting or canceling) although there it has not fully replaced traditional data lines. The change of tick size should make aggressive trading harder, but we don’t see this in the data,” he says.

Sources say the business case to use shortwave is limited to instruments that are tightly correlated, are widely traded, and trade across different geographic markets.

There are a few important signals, says Stéphane Tyc, co-founder of McKay Brothers, a low-latency microwave bandwidth provider. “For example, it’s movements in the S&P 500, some futures on oil, bond futures or agricultural futures instruments,” he says.

Alex Pilosov, whose claim to fame was exemplified in Michael Lewis’ Flash Boys and the film The Hummingbird Project as the first to build a microwave link from New York to Chicago, concurs. But Pilosov, who now serves as founder and CEO of Jersey City-based transoceanic infrastructure connectivity provider Shortwave Solutions, adds that when looking at other instruments, there aren’t many routes where a shortwave system would be worth it—where there’s enough liquidity and volatility to monetize the expense.

Part of this expense goes into hardware, software and other system requirements, as well as the expertise needed to handle challenges with atmospheric changes, limitations in bandwidth, throughput, and signal-to-noise ratios.

Making noise

The noise around the use of shortwave specifically for trading picked up in 2018 after Bob Van Valzah, who currently conducts low-latency market structure research at Citadel Securities, posted a series of posts after stumbling across evidence of a shortwave trading site in West Chicago, Illinois.

He wrote about his research and investigation results while on gardening leave on the Sniper in Mahwah blog hosted by Alexandre Laumonier, a book publisher and independent research on market microstructure. Van Valzah also spoke about his findings at the Securities Technology Analysis Center (Stac) Summit in May 2018.

Using the Federal Communications Commission (FCC) database and the experimental licensing system generic search, (click here for the step-by-step explainer) one can deduce based on the coordinates of the registered addresses in the current grants, that firms such as Jump Trading, IMC, Tower Research, Virtu, are using shortwave bands, and some of these firms are currently recruiting talent in radio frequency engineering expertise.

So, what’s so good about using shortwave for trading? In a nutshell, according to Raft Technologies, a Tel Aviv-based shortwave service provider, it allows firms to transmit long-distance data signals across land, and even oceans.

“The speed of light through air is 50% faster than the speed of light through glass or plastic in fiber links. This makes wireless faster, which saw the adoption for microwave radio pick up. But microwave frequencies cannot cross the ocean, and you need a microwave station every 100 kilometers or so. The only way to do wireless over long distances is using shortwave,” says Lior Katz, vice president, marketing and business development at Raft.

Today, Raft operates six ultra-low latency links between the US, Europe, and Asia. Katz says Raft’s latency link from New York to London is lower than 25 milliseconds, a 5-millisecond advantage over the “best fiber latency” of 30 milliseconds. Its Chicago-to-Tokyo link is less than 50 milliseconds, versus the “best fiber latency” of 58 milliseconds, while the London-to-Tokyo link is less than 50 milliseconds compared to the best fiber latency of 69 milliseconds, delivering a latency advantage of about 19 milliseconds.

Propagation power

According to Encyclopedia Britannica, shortwave radio or HF is the radio frequency band between 3 and 30 MHz, spanning wavelengths from 10 to 100 meters. These signals bounce off the ionosphere—the ionized part of Earth’s upper atmosphere, which is between 50 and 400 kilometers in altitude—to reach great distances.

A senior executive with over 25 years of experience in telecom infrastructure and networks, explains that the ionosphere is more of an electromagnetic layer. It’s one reason why the Northern Lights occur.

The perfect condition would be if there’s daylight in both transmit and receive sites

Haim Ben Ami, Raft Technologies

“It’s because the sun radiation and the flares and so forth create the radiation that is the ionosphere so it is a magnetic discharge. That’s why radio and GPS signals that travel the atmosphere and bounce off the ionosphere—and when we say bounce off, we’re really talking about it bouncing around—it’s not a solid layer you can just whack off of. It’s a thick, dense material that’s ricocheting against all the particles inside of it, in order for it to travel the curvature of the Earth,” the executive says.

Because it’s not definitive nor finite—unlike a brick wall a ball can bounce off—there can be a lot of interference, which is where the signal-to-noise ratio comes in. “Because you can have all sorts of atmospheric conditions, you get charged particles, that’s why we get Northern Lights, which is caused by the ionosphere, and which is why it glows. It’s active. And because it’s active, there’s always the chance that something’s going to interrupt a signal. I can sit there and be talking on an HF frequency, and everything sounds good. I’m talking to somebody really far away. And then suddenly, I lose the signal, and I have no idea why. It just happens because of atmospheric conditions,” they say.

But according to Raft CEO Haim Ben Ami, there is a “perfect condition” that would mean higher propagation power, which is transmission power.

“The perfect condition would be if there’s daylight in both transmit and receive sites. But if you have the technology to manage the conditions even when it’s daytime in Chicago and nighttime in Tokyo, then you will have a more available and stable link,” he says.

Raft had developed an in-house simulator that gathers indicators from several space weather websites. It then uses an AI system to learn, predict and recommend the best frequencies, as well as smart systems that constantly check it. “These three levels make sure we have good uptime with all our links around the globe,” Ben Ami adds.

Just some bits

But apart from dealing with different ionospheric conditions, perhaps shortwave’s biggest limitation is bandwidth, which essentially limits the message that can be sent from one point to another.

“For microwave networks, we are talking megabits. For HF, the message is limited to a number of bits, we are talking four bits, eight bits. And that’s all you get for a message. And it’s not obvious to convert trading data into a trading signal which is what you transmit over HF. So there is a little bit of work clients will need to do in order to make the best use of this technology,” Shortwave Solutions’ Pilosov tells WatersTechnology.

Pilosov is banking on his direct know-how and extensive research in the latency game.

Since beating Spread Networks—which invested $500 million into its fiber network between New York and Chicago—with a $500,000 budget, Pilosov dove deep into research on going across the ocean.

“Microwave has the limitation of line of sight, so you need to have towers in a straight line, and there are no towers in the ocean. So, I’ve done a number of research projects for putting antennas on balloons, airplanes, and helicopters. Eventually, I decided that for the kind of service that clients expect, the number of bits and the capacity is not that important. In short, shortwave will provide sufficient bandwidth or a sufficient amount of bits for my customers to be able to make money,” he says.

Pilosov has filed informal objections to several firms’ applications for international broadcast licenses with the FCC. He filed petitions against at least three firms—Parable Broadcasting, Raft, and Turms Tech LLC—claiming that they are trying to transmit private data using the FCC’s broadcast service (see box: ‘Regulatory arbitrage?’).

One bit can have two possible states, which is represented mathematically as n bit = 2n, so a bandwidth of 4 to 8 bits would allow a message containing between 16 and 256 states. For example, it takes 8 bits to represent a single character, say the letter ‘A’ in binary code. But this is more than enough, as Pilosov notes, for trading firms to make a gain on a trade.

Therefore, it is possible to send signals in a similar manner to Morse Code, where the receiver knows how to interpret the signals and the exact actions to follow. “Let’s say, that following a specific event you send a message that says ‘12.’ The other side knows what to do immediately when ‘12’ is received,” says Raft’s Katz.

Theoretically, it’s feasible to “intercept” and decode some of these signals

Stéphane Tyc, McKay Brothers

These signals would typically specify movements in instruments, in direction and magnitude, based on price and liquidity events such as stock changes and trade volumes.

Signals sent over shortwave would arrive milliseconds ahead of the complete market data carried over fiber connection. “It’s like receiving next week’s newspaper headlines today. It may just be the headline, but you’re getting it ahead of time,” he adds.

But there’s another shortcoming of radio waves: In theory, these signals could be intercepted and decoded. For example, if a trading firm were to always use the same bits to denote something, it is possible for another competing firm to pick up on the pattern and correlate the moves on the receiving end, says McKay’s Tyc.

“Theoretically, it’s feasible to ‘intercept’ and decode some of these signals. No encryption can save you from that, but whether it’s worth doing is another question altogether. It would require a lot more involvement in signal intelligence,” he says.

For example, if a firm were interested in intercepting a competing firm’s shortwave signals, they would need to take all the signals received in the HF band and correlate them with moves on say, Eurex and CME. It’s doable but tricky, Tyc says.

“If the intercepted firm notices that its signals are being intercepted, it could easily punish the interceptor by changing the meaning of the signals. So, it’s theoretically completely possible to intercept a signal, but it’s probably not a very good business proposal,” he says.

Hardware, software, and the last mile

Three main hardware components are necessary for shortwave to work: a modem, a power amplifier and an antenna. These are available off the shelf, but need to be customized to adapt to different frequencies, especially when propagation for a certain frequency is not as good as another at any given time.

“Our pathway is constantly changing; the atmosphere is changing all the time based on the time of day, night, and activity of the sun. These changes mean you need to adapt your frequencies, which means that your antenna, modem, and power amplifier need to be able to adjust to different frequencies,” says Raft’s Ben Ami.

Raft developed an in-house modem that can transmit and receive messages at ultra-low latency, as well as a power amplifier that has been tailored for low latency.

The antenna, the third component, assists in eliminating noise. For example, Ben Ami says when transmitting over the horizon for 10,000 kilometers, the signals received are very low, and there can be many sources of interference from the surroundings.

The gain of the antenna—the measurement of the antenna’s ability to direct the signal—is also important to be tuned to receive signals from the desired direction.

He adds that Raft built a system on top of these three main components, allowing it to provide an end-to-end communications service instead of users needing to build it on their own.

This is what I started with, and I can do that in my sleep. I created this industry

Alex Pilosov, Shortwave Solutions

On top of the equipment, firms in this space also need to have access to towers that are high enough to receive and transmit signals. These are typically at least 100 meters high, according to the senior telco infrastructure and network executive. And since these towers can’t be built close to exchanges, an additional network link—the “last mile”—is required to get the message into the exchange.

Raft is working with McKay for last-mile connectivity to get the signal from the radio tower to the exchange using microwave technology.

However, unlike Raft, Shortwave Solutions doesn’t rely on a third-party microwave provider for the last-mile connectivity.

“I build my own microwave links,” says Pilosov. “This is what I started with, and I can do that in my sleep. I created this industry. I don’t want to brag, but that’s how it all started, with the New York-to-Chicago microwave link.”

Shortwave Solutions currently has an operational link between the US and Europe exclusive to a single customer. Pilosov believes the business model for shortwave will be based on selling exclusive access.

“Obviously, the advantage here is that when I’m the fastest, that’s what my clients are paying for—to be the fastest. Because in the arbitrage game, there is no price or prize for being the second fastest, right?” he says.

Israel is very strong in wireless engineering and RF engineering

Haim Ben Ami, Raft Technologies

Shortwave Solutions is working on building out US-to-Asia links, from Chicago to Tokyo, Shanghai and Singapore. It has postponed by a year its planned Chicago-to-Tokyo link with a target latency of 36.5 milliseconds to optimize the existing European link.

Exclusivity may not necessarily be by geographic area, Pilosov adds. It could also refer to instruments. For example, for Shortwave Solutions’ upcoming Tokyo link, Pilosov says he would be open to selling facilities for Nikkei symbols, as well as potentially shared access for instruments that are not directly monetizable, such as FX rates.

Raft, meanwhile, is banking on its “strong” research and development capabilities. “We have very strong R&D capabilities. Israel is a good place to develop such technology. Israel is very strong in wireless engineering and RF engineering,” says Ben Ami.

The company was founded in 2013 and worked on a proof-of-concept until 2018, which led to the modem and then system development. It started with an operational time of four to six hours per day and has since improved on that to operate the links around the clock.

While the use of shortwave radio is increasing, by no means does it spell a bleak end to conventional fiber networks. It just means that the data transmitted over shortwave vs. fiber will vary due to the bandwidth limitation and throughput rates.

“There are conventional fiber networks that are used for other data. So you transmit most of the things that are not time critical with fiber, but the trading signals when the price changes (the actual arbitrage opportunity)—that goes over shortwave,” says Pilosov.

But the telco infrastructure and network executive doubts that shortwave will pick up steam. The ionospheric conditions or solar cycle are irrelevant, they say.

Those trying to trade large sums of money and deal with a technology that is maybe 4 to 8 milliseconds faster than the alternative are not going to care which solar cycle we’re in. A loss or degradation in signal and it’s game over, the executive adds.

It’s the reliability question, they say. “The providers think they can make it super reliable. I’m not going to call ‘bull’ on it, but I’ll say the technical challenges associated on either transmitting and receiving end are complex enough. And then what you have in the middle is mother nature, and there’s only so much you’re going to be able to do with predicting how she’s going to act,” the executive says. “So, while I think it’s interesting, I don’t think it’s got legs.”

And yet, the pursuit of being the fastest continues, and shortwave, or HF, is just one of the ways to get there.

Regulatory arbitrage?

With any form of innovation, regulation is almost always at least one step behind. The same is true when it comes to using shortwave radio frequencies for trading.

Shortwave was first introduced in the early 20th century, when Guglielmo Marconi, an Italian inventor and electrical engineer, began work on the first transatlantic broadcast.

Thanks to data from platforms such as Deutsche Börse’s A7 Analytics Platform, industry observers can see that the use of shortwave is increasing. But whether or not these users fall into a gray area when it comes to licensing and how they’re using shortwave is debatable.

Shortwave Solutions founder and president Alex Pilosov, who built the first microwave link between Chicago and New York, has filed several informal objections against several firms, including Parable Broadcasting, Raft Technologies, and Turms Tech, claiming their application for a broadcast license with the Federal Communications Commission (FCC) in the US is not aligned with their use case.

“The main problem for anyone who is trying to do broadcast and market data is that it’s not both. [Parable, Raft, and Turms] are trying to transmit private data using the broadcast service,” he says.

He continues: “The interesting part is that there have been cases in 1950, and even in the 1930s where the FCC said that this kind of use is not broadcast. This was the horse racing results example, where horse racing results were being transmitted to the bookmakers. So there is a precedent there and a clear case law about this kind of use not being broadcast. This is the core problem: trying to push private data in the broadcast service.”

All three firms Pilosov filed petitions against have responded separately in several opposition filings. The FCC has yet to issue any statement or decision on the outcome of Pilosov’s objections.

Raft’s CEO Haim Ben Ami insists that the firm transparently communicates with the FCC and other regulatory bodies, like Ofcom, the UK’s communication regulator.

“When you’re developing a technology which is using frequencies, you need to develop the regulatory environment as well. The frequencies are an asset of the public,” he adds.

These regulators also have a responsibility to make sure use of these frequencies happens fairly and doesn’t disrupt other users of the spectrum.

“Every country has a structure of experimental and commercial licenses. They live together; you can’t do one without the other. When you’re developing a new spectrum and new technology, the experimental is used to do tests including market trials while you’re applying for the commercial,” he adds.

Stéphane Tyc, co-founder of McKay Brothers, says regulation is one of the big potential challenges to the development of shortwave. “We hope that regulatory bodies, such as the FCC, clarify their regulation, because it’s currently unclear what is definitively allowed and what is not,” he says.

McKay is working with Raft Technologies to supply the “last mile” connectivity to get that information from the radio tower to the exchange using microwave technology. But Tyc argues that any changes in regulation won’t have a huge impact on McKay, as it’s only enabling firms like Raft.

“My concern is more about understanding what the rules are. Because when you have rules that are unclear, it favors regulatory risk-taking,” he adds.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@waterstechnology.com

More on Trading Tech

For MarketAxess, portfolio trading buoys flat revenue in Q3

The vendor is betting on new platforms like X-Pro and Adaptive Auto-X, which helped forge a record quarter for platform usage.

Quants look to language models to predict market impact

Oxford-Man Institute says LLM-type engine that ‘reads’ order-book messages could help improve execution

JP Morgan pulls plug on deep learning model for FX algos

The bank has turned to less complex models that are easier to explain to clients.

Nasdaq says SaaS business now makes up 37% of revenues

The exchange operator’s Q3 earnings bring the Adenza and Verafin acquisitions center stage.

Harnessing generative AI to address security settlement challenges

A new paper from IBM researchers explores settlement challenges and looks at how generative AI can, among other things, identify the underlying cause of an issue and rectify the errors.

The causal AI wave could be the next to hit

As LLMs and generative AI grab headlines, another AI subset is gaining ground—and it might solve what generative AI can’t.

Waters Wrap: Operational efficiency and managed services—a stronger connection

As cloud, AI, open-source, APIs and other technologies evolve, Anthony says the choice to buy or build is rapidly evolving for chief operating officers, too.

BlackRock forecasts return to fixed income amid efforts to electronify market

The world's largest asset manager expects bond markets to make headway once rates settle.